Glenmede Investment Management

Consistent. Transparent. Accessible.

A Multi-Asset Class Boutique

Glenmede Investment Management (“GIM”) is an independently owned boutique asset management company offering actively managed equity, fixed income, derivative, and environmental, social and governance (“ESG”) strategies. We serve a global client base of institutions, consultants and advisors.

Through experienced, collaborative teams and the implementation of a comprehensive investment approach, we seek to provide long-term value that addresses various investment objectives for our investors.

Focused Experience

Our infrastructure empowers our tenured investment management teams to be agile, responsive and flexible.

The markets are in constant motion. Our investment and portfolio management teams stay on top of market trends to remain focused on our investors’ investment objectives. Learn More.

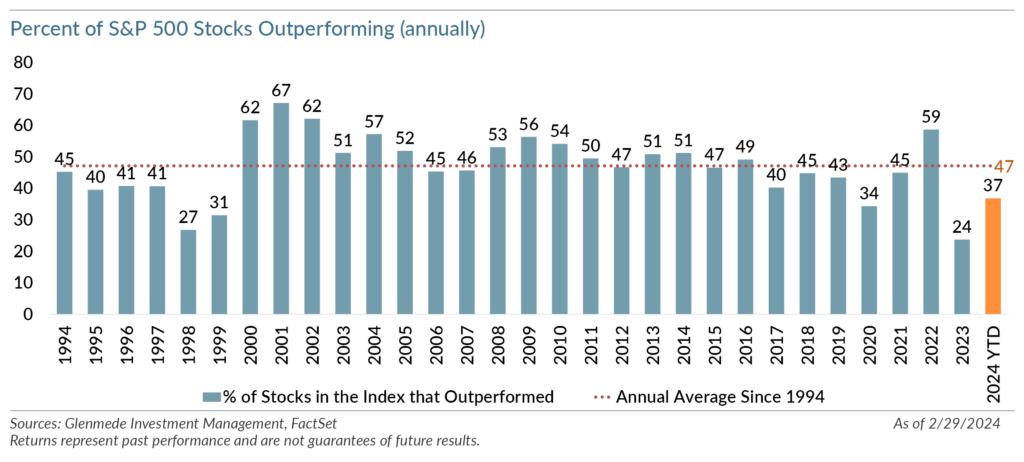

Actively Managed Investment Solutions

Our experienced teams steer actively managed investments through all market environments. With critical assessment of assumptions, we consistently explore, analyze and vet approaches to help investors achieve their investment objectives.

GIM’s investment strategies include a diverse and broad range of asset classes available through multiple investment vehicles: separately managed accounts, model portfolios, collective investment trusts and our family of mutual funds.

Investment Philosophy

To outperform the benchmark over a full market cycle through a diversified approach focused on in-depth fundamental research.

Investment Philosophy

To generate attractive risk-adjusted returns employing a quantitative discipline based on fundamental insights with the goal of seeking a balanced set of attributes that lead to benchmark outperformance over market cycles.

Investment Philosophy

To deliver attractive risk-adjusted returns by managing interest rate risk, focusing on high credit quality securities and applying diversification across the principal sectors.

Investment Philosophy

To capture premium income generated by option writing to potentially improve long-term returns.

Investment Philosophy

To seek risk-adjusted returns incorporating environmental, social and governance (ESG) information, — where material — as part of our investment strategies.

The Glenmede Trust Company (GTC) established

Glenmede launches Mutual Funds (The Glenmede Funds)

Developed Fundamental Equity Strategies

Glenmede Advisors, Inc. was formed to run the mutual funds

Launched Quantitative Strategies

Initiated management of environmentally sensitive portfolios

Launched Options Strategy

Developed Liquid Alternative Strategies

Glenmede Investment Management was formed ($6B AUM)

Developed additional ESG Strategies

$ 11.5 AUM as of 6/30/23

Disclosure: This website is for informational purposes only. GIM products are actively managed and their characteristics will vary. All investment has risk, including the risk of loss of principal. There can be no assurance that efforts to manage risk or to achieve any articulated investment objective will be successful. An investor should consider investment objectives, risks, charges and expenses carefully before investing. For additional information regarding risks and about the firm, please refer to Related Literature and Disclosures.