Market Snapshot: Tax-Aware Rebalancing with Options

Equity markets have staged a dramatic rally since their early April lows, leaving many investors with portfolio allocations meaningfully above target levels. The standard course of action would be to sell equities and reallocate to underweighted asset classes. For taxable investors, however, the willingness to realize large additional capital gains in the current year can be a constraint.

In this context, listed index options offer a practical alternative. Purchasing long-dated S&P 500 put options can serve as a synthetic rebalancing tool, de-grossing equity exposure while deferring taxable sales until a later date.

The mechanics are relatively straightforward. A put option struck at or near the current level of the index provides the cleanest and purest hedge, while options struck modestly out of the money—for example, 10% below spot—reduce the cost of protection at the expense of requiring some drawdown before paying off. The notional amount should be properly aligned with the excess equity exposure in the portfolio.

If the market declines, the put options generate cash proceeds at expiration that can be redeployed into underweight asset classes, restoring balance without having to trigger gains in the underlying equities. If the market instead rises, the option expires without value. In that case, the option premium could result in a recognized tax loss. Under Section 1256 tax treatment, index option gains or losses are automatically characterized as 60% long-term and 40% short-term, regardless of the actual holding period. A loss may be used to offset realized gains when equities are ultimately sold to complete a rebalance, possibly in a fresh tax year.

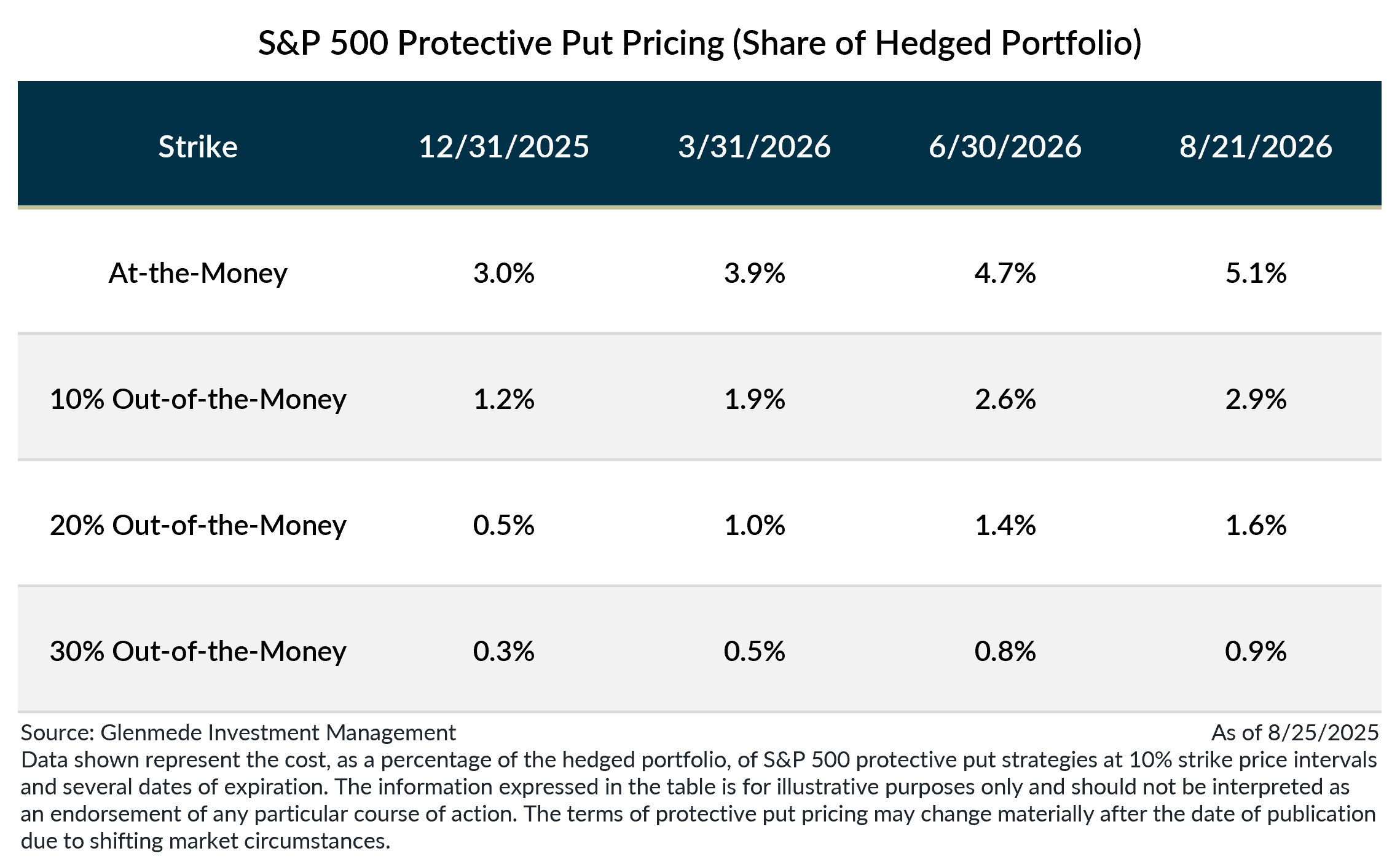

A review of current option quotes illustrates the trade-offs between strike level, expiration and hedging cost. An at-the-money put expiring at the end of Q1 2026 carries a cost of approximately 3.9% of the equity value in the portfolio. However, a similar put expiring in August 2026 costs 5.1%. Moving the strike lower, for example to 10% out of the money, reduces the premium to 1.9% for the shorter expiration and 2.9% for the longer-dated option. These figures highlight the general principle: premiums increase with longer durations and with higher levels of protection closer to the current index level. This framework allows investors to calibrate hedges according to both risk tolerance and a cost budget.

While option premiums represent a meaningful cost, they can be viewed as the price of flexibility, potentially allowing portfolios to remain aligned with long-term allocation targets while deferring taxable events. In years when equities have appreciated significantly, S&P 500 puts may offer a structured way to assist in managing risk exposures within the constraints of the tax calendar.

Sean Heron, CFA

Portfolio Manager, Derivatives

Glenmede Investment Management

A protective put strategy involves holding a position in a stock or a basket of stocks while simultaneously buying a put option on the same stock or stocks to limit downside risk while retaining upside potential. Strike price refers to the predetermined price at which the holder of an option can buy the underlying asset in the case of call options or sell the underlying asset in the case of put options. An option is “at-the-money” when the strike price is equal to the current market price of the underlying asset and “out-of-the-money” when the strike price is less favorable than the market price. Section 1256 refers to a provision in the U.S. tax code that taxes certain regulated futures, foreign currency contracts and options at a blended 60% long-term and 40% short-term capital gains rate, regardless of the holding period. In practice, protective put strategies may be imperfect hedges due to basis risk, which occurs when the value of the put option may not move perfectly in line with the value of the underlying asset. Options may not be appropriate for all investors. Investors should consult with a qualified financial advisor to determine the suitability of any options strategy. The information provided herein is for informational purposes only and should not be construed as tax advice. Investors are advised to consult a qualified tax professional to determine the most appropriate course of action for their individual circumstances.

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.