Market Snapshot: Reconciliation Bill Becomes Law

The long-awaited “One Big Beautiful Bill Act” (OBBBA) has completed its long journey through Congress and was signed into law by the President last week. To meet a self-imposed July 4th deadline, the House of Representatives fast-tracked the legislation by adopting the Senate’s version of the bill.

With a cumulative price tag of $3.3 trillion, the OBBBA includes much of the President’s wish list, highlighted by a full extension of expiring provisions from the Tax Cuts and Jobs Act of 2017 (TCJA). Other notable components include, but are not limited to:

- No federal income tax on tips, overtime pay or auto loan interest

- A higher cap on state and local tax (SALT) deductions

- Full expensing for manufacturing structures

- A new tiered excise tax on private higher education institutions

Equally important are the items left on the cutting room floor: no new tax bracket for millionaires, no changes to municipal bond tax exemptions, no new levies on private foundations and no formal retaliation against foreign tax regimes.

For investors, it is important to keep the broader fiscal policy landscape in view. Zeroing in on either tax or trade policy in isolation risks missing the bigger picture. While the OBBBA and recent tariffs are not direct offsets, the new fiscal support could help counteract some of the drag from trade frictions in 2025 and lay the groundwork for more meaningful net stimulus in 2026.

Longer-term, the two policy tracks may prove complementary toward the administration’s goal of incentivizing onshore production. Full expensing for domestic manufacturing investment could serve as the “carrot,” while tariffs act as the “stick.” Together, both angles sketch the outline of an emerging U.S. industrial policy.

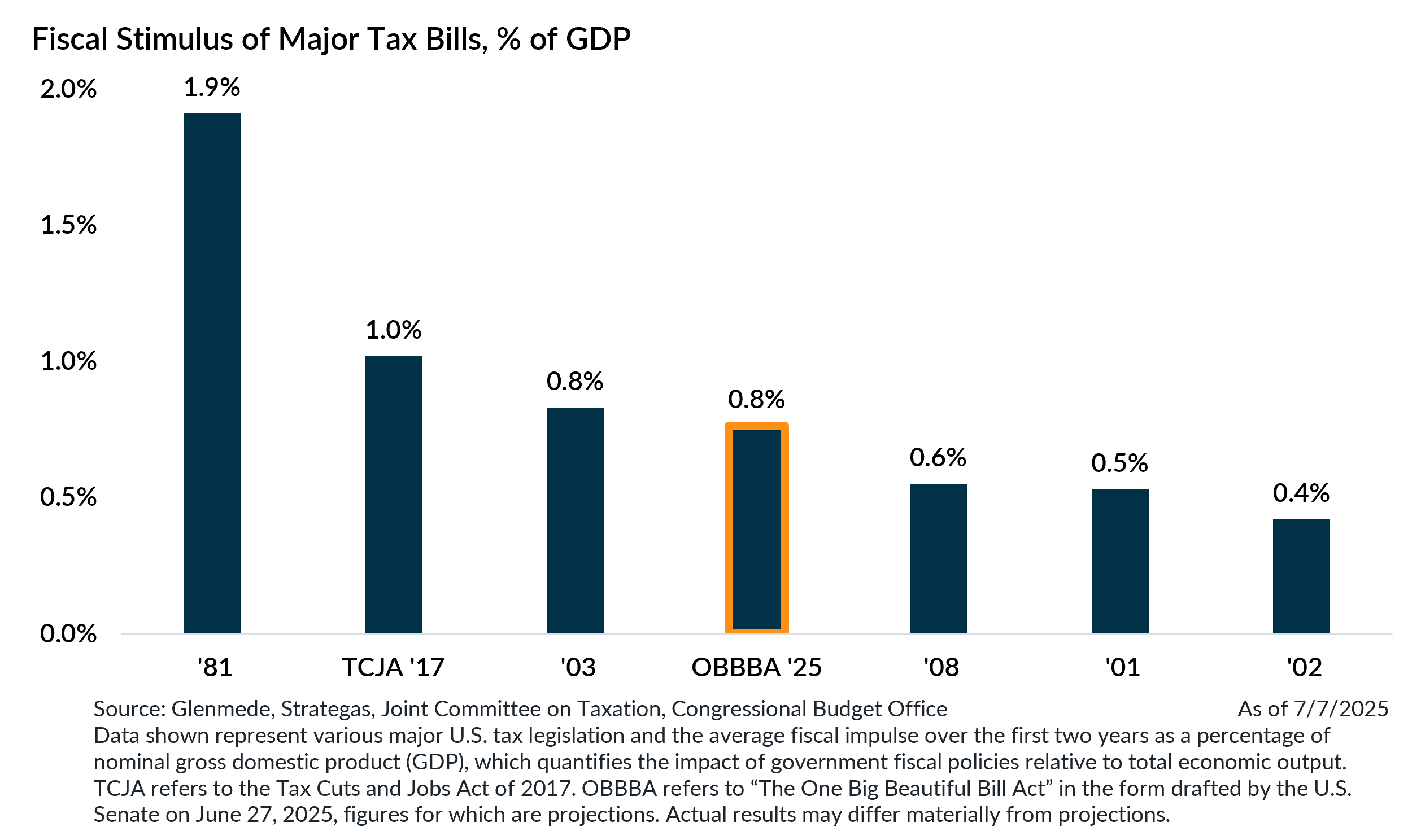

So where does the OBBBA rank in terms of historical fiscal stimulus? Among the seven major tax packages since 1980 that were net stimulative, the OBBBA lands somewhere in the middle in terms of the economic impact in the first two years. Comparisons to the TCJA are natural and, in headline terms, the OBBBA is likely to deliver a similar, if slightly smaller, boost to growth. That said, the scale of proposed tariffs this time around is far greater than what followed the TCJA.

Taken together, the OBBBA carries meaningful implications for the U.S. economic outlook. Just one quarter ago, the domestic economy was staring down disruptive tariffs proposed on “Liberation Day.” With the 90-day pause on reciprocal tariffs expiring this week, trade policy remains a key wild card. Still, the fiscal thrust of the OBBBA may give the U.S. economy a broader pathway to weather the largest tariff increase since Smoot-Hawley without necessarily tipping into recession.

Jason Pride, CFA

Chief of Investment Strategy & Research

Glenmede

Michael Reynolds, CFA

Vice President, Investment Strategy

Glenmede

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.