Market Snapshot: Tariff Rates, Market Risks, and Corporate Reluctance

Each year of the 2020s has featured market volatility driven by distinct catalysts. In 2020, COVID-19 fears dominated markets. Volatility subsided in 2021 but remained elevated around Federal Reserve meetings. In 2022, as inflation surged, markets experienced unusually high volatility around release dates for the Consumer Price Index. Recession concerns took the spotlight in 2023, driving volatility around monthly jobs reports. In 2024, the Fed once again became a primary volatility driver.

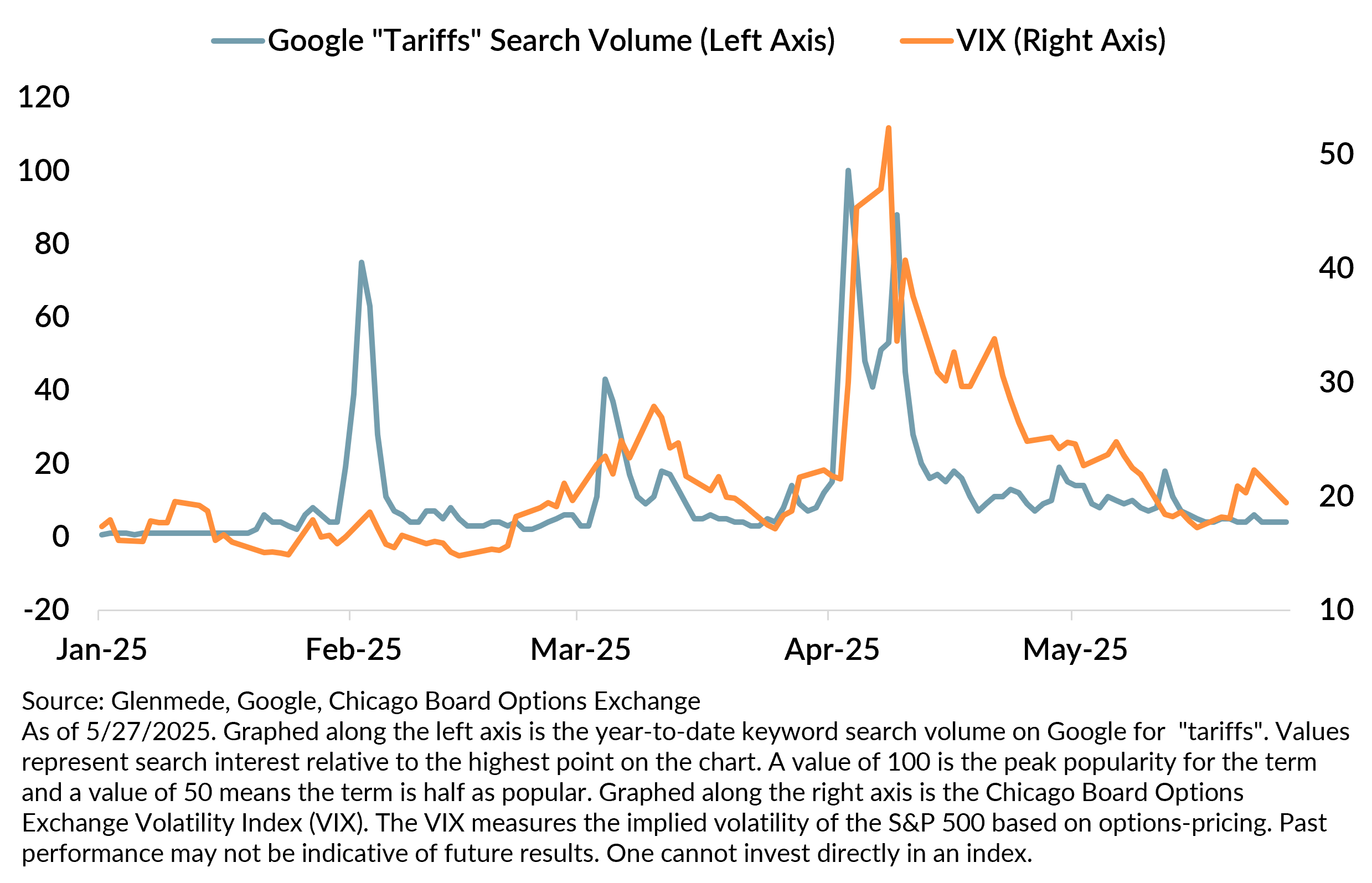

In 2025, trade policy has emerged as a predominant catalyst, with last week’s tariff announcements targeting the European Union and iPhone imports serving as a fresh reminder. Year-to-date, there has been a 0.65 correlation between Google search interest in “tariffs” and the level of the VIX. This relationship depicts options-implied market volatility (expected annualized standard deviation of S&P 500 returns) as high as 45% when tariffs dominated headlines versus about 19% when tariffs were least in the news.

Trade-related volatility may have peaked in response to the “Liberation Day” tariff announcements as some of the most aggressive proposals have been postponed or taken off the table for now.

However, that does not mean volatility has been fully extinguished. The trade policy outlook remains uncertain as negotiations continue with major trade partners, leaving ample opportunity for further market surprises.

Volatility affects more than just markets — it can also influence corporate behavior. Historically, high implied volatility has been associated with reduced corporate investment. Since 2000, during periods of average volatility, capital expenditures (capex) have typically increased by +5 to +10%. In contrast, during periods of elevated implied volatility (i.e., VIX above 35), capex has often declined.

This year appears to be following such a pattern. The uncertainty introduced by evolving tariff policies has led many corporations to withhold earnings guidance and delay key investment decisions. That hesitation runs counter to the administration’s objective of encouraging domestic manufacturing in the near term. Over the longer run, if bilateral trade negotiations result in greater clarity on terms of trade, it could help remove a major source of market volatility and investor fear, while enabling businesses to deploy capital and hire the talent needed for future growth.

Val deVassal, CFA

Portfolio Manager

Equity

Glenmede Investment Management

Alex Atanasiu, CFA

Portfolio Manager

Equity

Glenmede Investment Management

Related Insights

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.