Market Snapshot: Taxes & Tariffs – The Two Faces of Fiscal Policy

The House of Representatives passed the One Big Beautiful Bill (OBBB) on May 22nd, advancing the reconciliation process to the Senate where it may undergo further revisions. Much has been written about the potential impact on the federal budget deficit. According to the Congressional Budget Office (CBO), the bill in its current form is projected to cost approximately $2.4 trillion over the next 10 years. While some details may change in the Senate, the core elements of the bill are likely to remain intact.

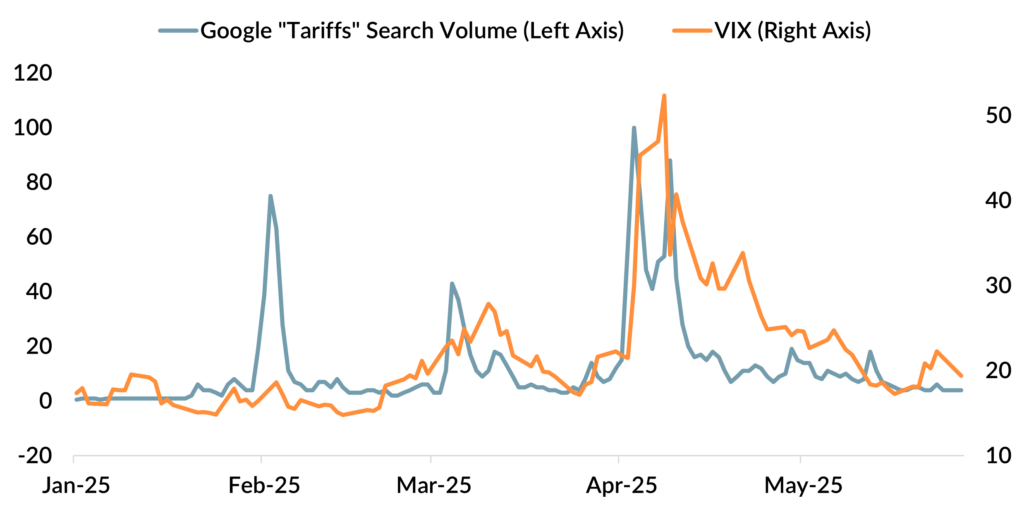

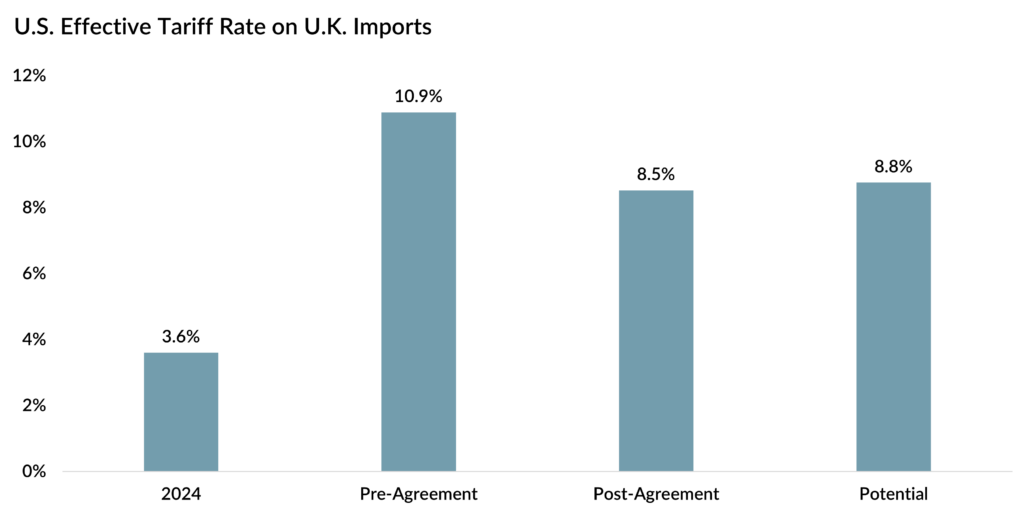

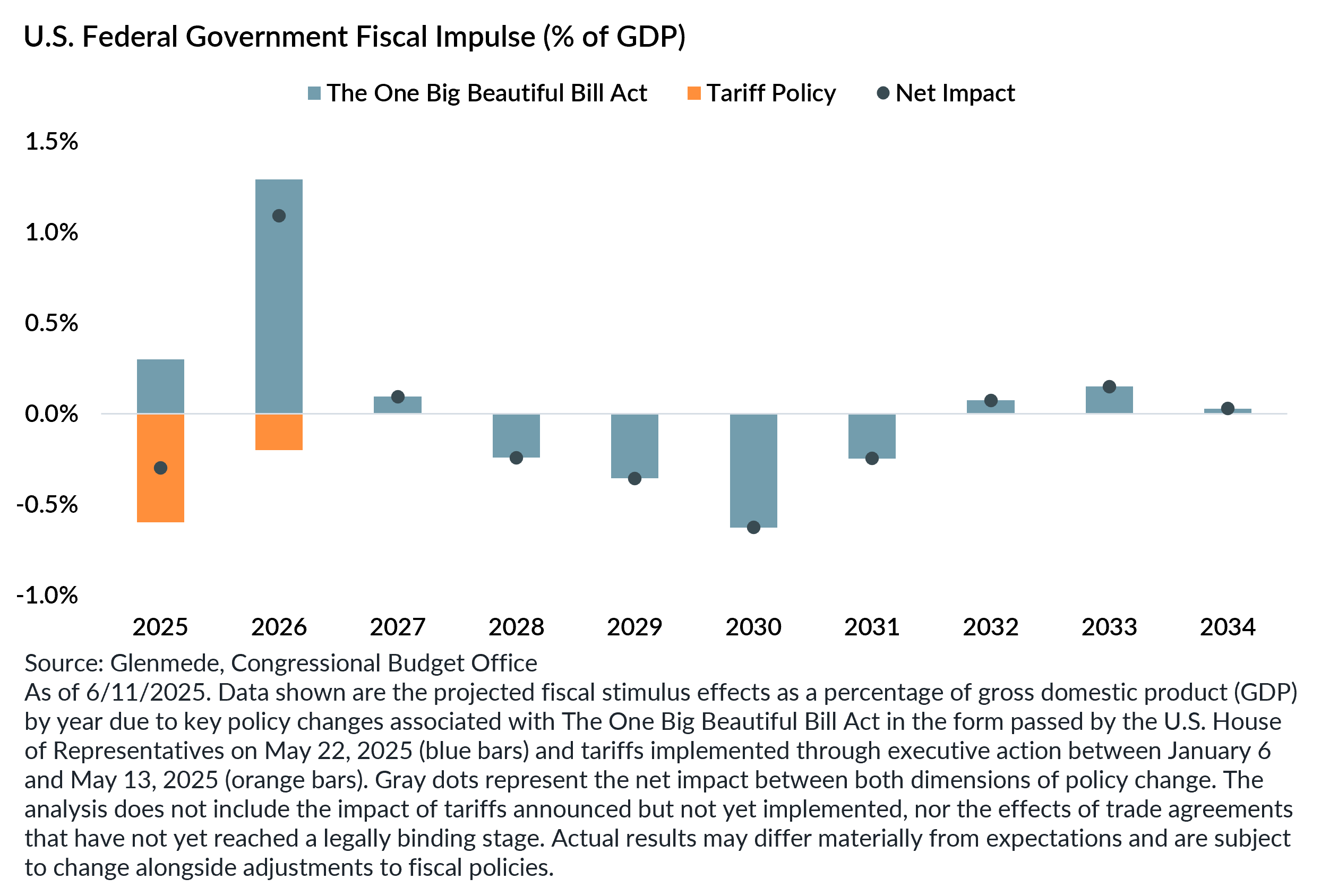

Importantly, the costs of the OBBB are not proposed in a vacuum. Significant changes to tariff policy this year are projected to have substantial revenue-raising effects. In a separate study, CBO estimates that tariffs implemented so far in 2025 may generate $2.8 trillion over the same 10-year window, after accounting for the interaction effects with economic growth. That figure may prove imprecise, as a few additional tariffs have been announced but not yet enacted. Moreover, ongoing negotiations with trade partners could lead to concessions, such as those already seen in the preliminary U.S.-U.K. agreement. Still, the broader picture is clear: tariffs may ultimately provide the funding to offset much of the new spending and tax cuts in the OBBB.

The timing of this combined fiscal impulse is particularly important for investors. If tariffs are imposed and become a fixture of trade policy for the foreseeable future, the resulting drag on GDP is likely a one-time hit concentrated in the rolling 12-month period following implementation. In this case, that is mostly a 2025 headwind with residual effects in 2026. In contrast, the varied provisions in the OBBB create near-term stimulus, with offsetting revenues concentrated in the later years of the 10-year budget window.

At a more granular level, the retroactive application of many OBBB provisions may pull forward some of the fiscal boost into 2025. However, there are limits to how quickly that stimulus should hit the economy. For instance, it is too late to adjust individual tax withholding schedules, meaning some of the 2025 benefits may hit consumers’ pockets in early 2026 when Americans file their taxes. Practically speaking, that could mean large refunds reminiscent of COVID-era stimulus checks may be just around the corner.

On the tariff front, ongoing legal challenges to the administration’s use of the emergency powers could prove moot over the long term, as several alternative trade authorities (Sections 122, 232, 301, and 338) remain available. With that said, the Supreme Court could still rule that all tariffs collected under the International Emergency Economic Powers Act must be refunded. If so, that would merely shift the timeline of tariff impacts, possibly syncing them more closely with the OBBB’s offsets, while the refunds themselves may feel like one-off stimulus.

Taken together, the fiscal landscape may be more balanced than it first appears. While the fates of both trade policy and the OBBB remain uncertain, the tracks appear to be laid for a path that can help the U.S. economy avoid recession this year. For investors and policymakers alike, the next several quarters will hinge not just on what gets passed, but on when and how it hits the real economy.

Jason Pride, CFA

Chief of Investment Strategy & Research

Glenmede

Michael Reynolds, CFA

Vice President, Investment Strategy

Glenmede

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.