Market Snapshot: The Hawks, the Doves, and Stephen Miran

The FOMC’s September meeting came just a day short of the one-year anniversary of its last rate cut, a fitting backdrop to resume easing. The Committee’s decision to cut rates by a quarter point was unsurprising. It all fit squarely with the forward guidance offered by Fed officials in recent months, highlighting the emerging cracks in the labor market. This thought process is perhaps best captured by this newly crafted sentence in the statement: “The Committee is attentive to the risks to both sides of its dual mandate and judges that downside risks to employment have risen.”

But like chess players studying the same board, policymakers appear to agree on the state of play without consensus on the next move. That divide is most visible in the dot plot, where three distinct camps are emerging on policy through year-end: the hawks who would wait for clearer signals, the doves already inclined to further steps toward neutral, and a lone outlier favoring faster cuts.

Seven participants in the dot plot projected no further cuts this year. This group may see September’s cut as justified by labor market risks but that it remains premature to commit to a full easing cycle. Chair Powell’s reference in his press conference to this month’s rate cut as a “risk management cut” nodded to this view. For the hawks, this may be less the start of a regimented cycle and more a one-and-done adjustment unless and until conditions justify otherwise.

The “dovish” camp contains members seemingly ready to pencil in a few more rate cuts by year-end. If realized, that could mean cuts at the remaining meetings in 2025. This group appears sufficiently concerned about weaknesses in the labor market to begin nudging policy closer to a neutral stance, though they may remain open to adjusting that course if warranted by the data. Powell may have acknowledged this line of thinking during the press conference Q&A as well. When asked whether a single quarter-point cut would be enough to address labor market softness, he referenced market expectations for a broader “rate cut path,” while carefully noting that he was not personally endorsing that trajectory.

Put simply, the hawks may want to see more data before calling for more cuts, whereas the doves may want to see more data before being convinced not to cut. The third camp, seems to need little convincing. One outlier submitted a dot suggesting that an extra 1.25% in rate reductions would be appropriate this year. It is a small logical leap to assume newly minted Governor Stephen Miran placed this dot. The dot plot contains 19 dots, implying full participation despite Miran’s confirmation less than 24 hours before the meeting. He did not participate in the June survey, which included no similar outlier opinions. He was also the sole dissenter in the rate decision, favoring a larger half-point cut.

Notably, the dot plot is the only element of the Summary of Economic Projections with such an outlier, suggesting that Miran’s broader economic outlook is not materially different than his colleagues. Similarly, that same dot plot shows little differentiation in the estimates for interest rates for 2028 and the long run. Altogether, this appears to be a view that monetary policy is best positioned to achieve the Fed’s dual mandate by moving to a neutral stance sooner rather than later.

Perhaps that thought process is a challenge to the Fed’s incrementalist approach as of late. All it takes is a cursory look at the history of the effective federal funds rate to observe that U.S. monetary policy has not always been so gradual. Over time, the shock and awe approaches of Chairs Volcker and Greenspan eventually gave way to a more slow moving and relatively well-telegraphed approach under Chairs Bernanke, Yellen and Powell. While this third camp at first glance appears to have staked a position out in left field, they may simply be looking to set up their tent a bit earlier than the others.

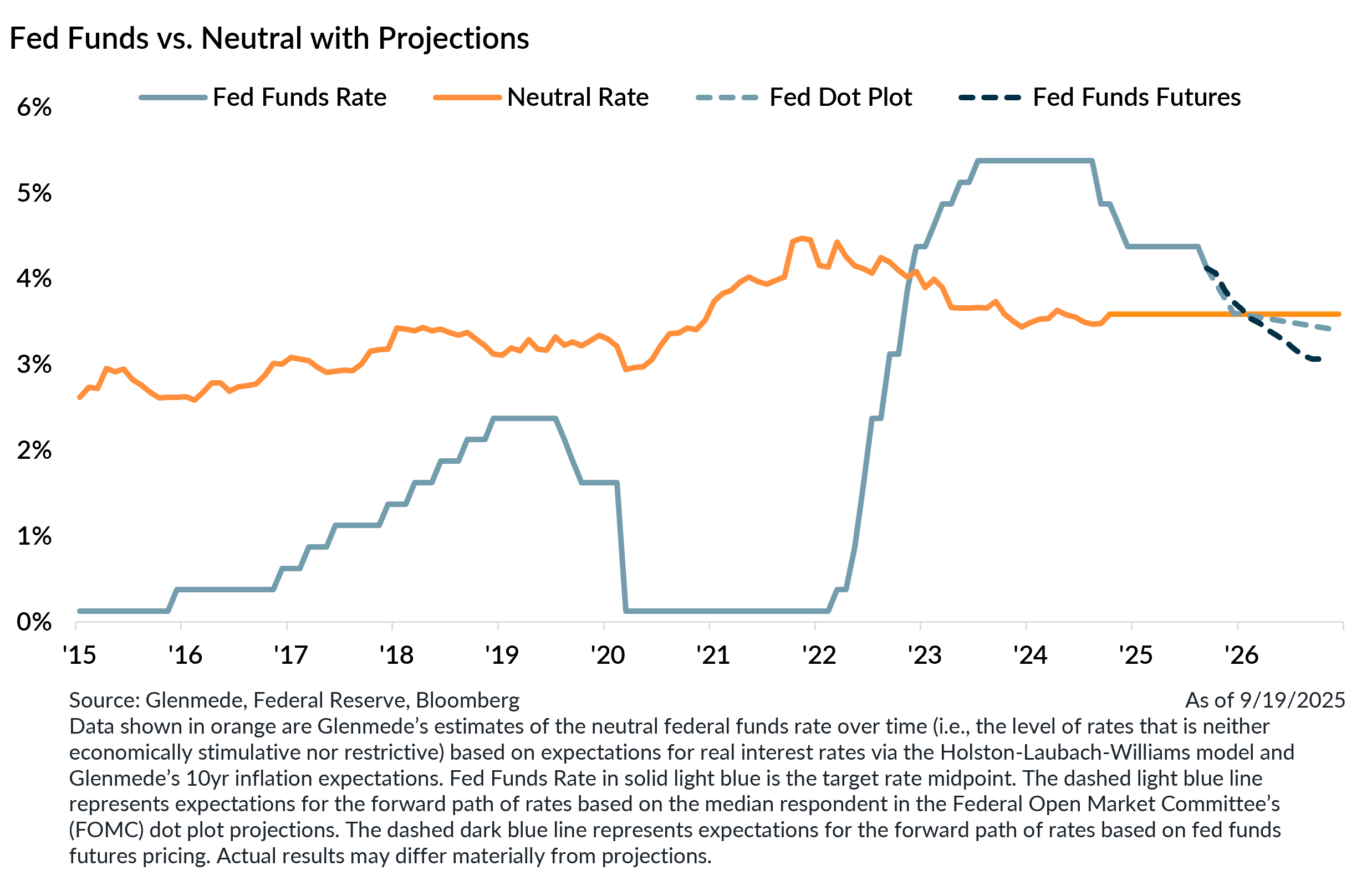

The path forward for monetary policy, while directionally pointing to further easing at this time, is far from guaranteed. Legitimate debates remain regarding exactly how much further to cut rates and how quickly to do so, which will be heavily influenced by the labor market and inflation data to come in Q4. A reasonable base case scenario is that another 1-2 rate cuts may be appropriate by year-end and potentially a few more in 2026 that take monetary policy from a restrictive to more neutral posture. Until then, investors should keep a close eye on the contours of the debate between these three camps.

Jason Pride, CFA

Chief of Investment Strategy & Research

Glenmede

Michael Reynolds, CFA

Vice President, Investment Strategy

Glenmede

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.