Market Snapshot: The High Price of No Profits

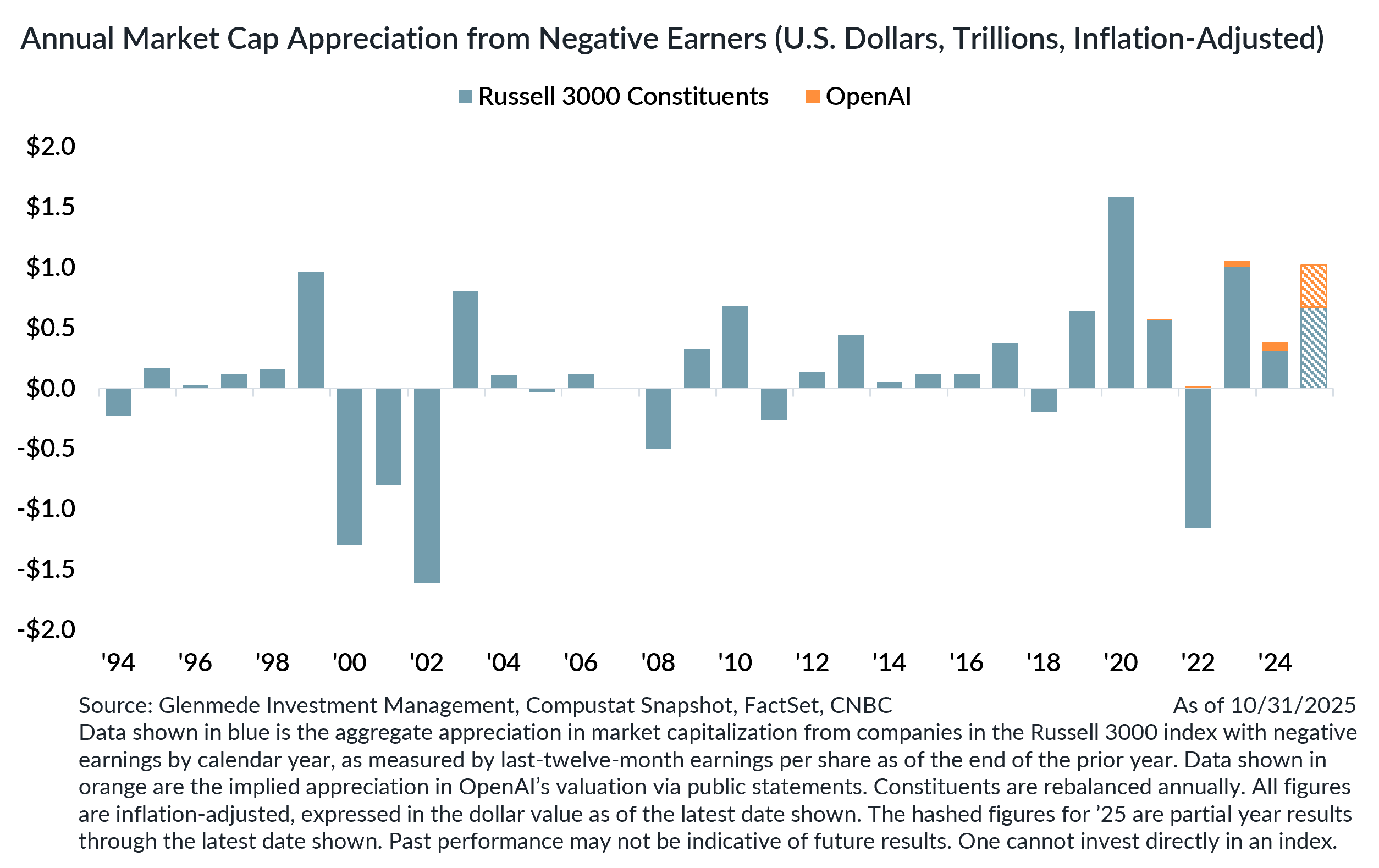

Negative-earning companies in the Russell 3000 have contributed meaningfully to total market cap gains in five of the last six full calendar years. If the first 10 months of 2025 are any indication, this year appears likely to make it six of the last seven. This is an unusually long stretch by historical standards; even then the data may be understating how dramatic the period has been.

Companies have been staying private for longer. A growing share of early-stage value creation occurs outside public markets, especially during the unprofitable phase of a company’s development. Private capital tends to be patient, more willing to tolerate large upfront losses in order to scale a business model before profitability is in sight.

OpenAI is shaping up to be a historic test of that patience. It has become the poster child for exuberance around loss-generating businesses, with widespread attention on its rapidly rising valuation despite enormous projected losses. Public reports suggest OpenAI could post exceptionally large operating losses through 2030, including an estimated $74 billion in losses expected in 2028 alone. For now, its private status has kept these dynamics outside major index performance aggregates. However, had OpenAI existed in the late 1990s, it is hard to imagine it would not have gone public to ride the early internet wave.

While OpenAI grabs the headlines, it is far from an outlier. It is simply the most visible example of a broader trend that has taken hold in recent years. Its trajectory also highlights how today’s environment echoes past periods of optimism toward unprofitable firms, even though historical data may not have fully captured private-market gains during the dot-com era.

The broader lesson, however, does not hinge on a single company. When aggregate losses stretch into the tens of billions, and potentially into the trillions, forward returns become increasingly sensitive to even small shifts in expectations. This is particularly true for business models that depend on meaningful cash burn today while offering uncertain prospects for future earnings.

Market-cap gains fueled by exuberance can unwind quickly when sentiment cools or funding conditions tighten. The years following the peak of the Internet Bubble, and again after the Fed’s rapid rate hikes in 2022, offer clear reminders of how quickly trillions of dollars in market value can evaporate when investors chase rallies led by unprofitable companies.

The fundamentals supporting the recent equity rally call for a measured degree of caution. History tends to reward discipline, especially when market leadership is driven by companies that have yet to prove their earning power.

Val deVassal, CFA

Portfolio Manager, Disciplined Equity

Glenmede Investment Management

Alex Atanasiu, CFA

Portfolio Manager, Disciplined Equity

Glenmede Investment Management

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.