Market Snapshot: Trade Deal Dominos Begin to Fall

The contours of a new “U.S.-U.K. Economic Prosperity Deal” were announced last week, marking what could be the first of many more trade agreements to come. Key provisions include preferential treatment for British autos/parts, steel, aluminum and pharmaceutical products entering the U.S. In exchange, the U.K. pledged to reduce tariffs of its own, improve market access (highlighted by beef) and address non-tariff barriers.

Technically, the U.S. and U.K. have been without a formal trade agreement since the U.K. exited the European Union. It is thus little surprise they were the first to reach a deal. Given that many of these discussions with other trade partners are occurring in parallel, this gives investors the first real glimpse into how the administration might structure future deals.

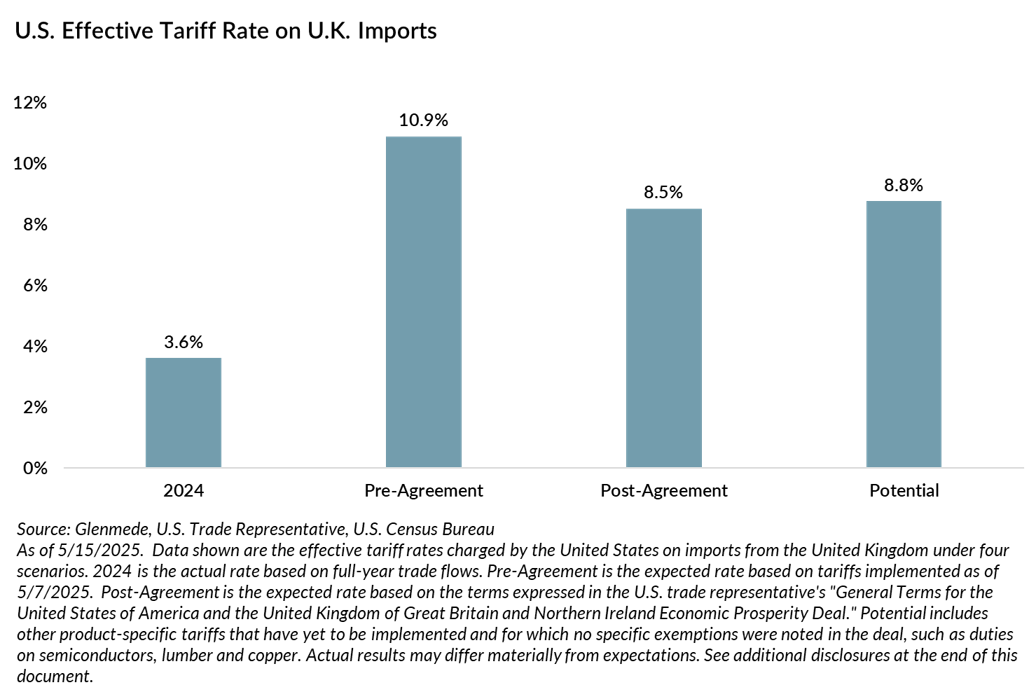

There are several takeaways from this agreement. Importantly, it does not appear that wholesale exemption from the 10% universal baseline tariff is a concession the administration is willing to make. However, under the right circumstances, some product-specific tariffs appear to be negotiable. The reduced tariff rate for the first 100k British vehicles entering the U.S. is essentially a removal of the 25% auto tariff; given that the U.S. imported 99k in 2024, all such imports would likely benefit, as long as volumes do not rise meaningfully. It does not appear that U.S. negotiators viewed the trade balance in autos alone as an impediment to that concession, given the U.K. ships 4-5x more vehicles (in both units and dollar value) to the U.S. than vice versa. Autos and auto parts represent ~14% of all imports from the U.K., so this exemption has the largest impact on effective tariff rates. In contrast, steel and aluminum represent less than 1% of imports from the U.K., so exemption from those product-specific tariffs was a relatively easy concession for the U.S. to make.

However, it is unclear how applicable this deal will be to other trade partners. The U.S. and U.K. have had a historically special relationship that may have helped smooth some of the rough edges in negotiations. Also, the U.S. had a trade surplus with the U.K. last year – this may have been important given the administration’s heavy focus on current account balances. It is difficult to imagine other countries getting such favorable deals, especially those with which the U.S. has had persistently large trade deficits.

The overarching takeaway is that the administration appears to be softening its hardline ideological stance on trade. Whether this is a feature to be expected from all trade deals to come or an exception for a friendly country will be important to monitor as pen is put to paper on additional agreements.

Jason Pride, CFA

Chief of Investment Strategy & Research

Glenmede

Michael Reynolds, CFA

Vice President, Investment Strategy

Glenmede

Related Insights

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.