The Quarterly Letter Q2 2025: Economic & Market Recap

Executive Summary

- Aggressive trade policy shifts and geopolitical tensions dominated headlines in Q2, but the U.S. economy remained remarkably resilient despite considerable uncertainty.

- The Federal Reserve held rates steady amid tariff-induced inflation concerns, while fiscal debates intensified as Congress advanced major tax and spending legislation ahead of a looming debt ceiling deadline.

- The S&P 500 narrowly avoided a bear market before staging a sharp rebound to new all-time highs, underscoring the opportunity costs of de-risking amid volatility. Treasury yields responded to debt and deficit sustainability concerns.

- The details of government policy are expected to shape the outlook for the remainder of 2025, which remains highly path dependent.

Tariffs, Foreign Policy & a Resilient U.S. Economy

A turbulent Q2 was kicked off in early April by President Trump’s self-styled “Liberation Day” tariff announcement, which called for 10% universal tariffs and reciprocal tariff rates that well exceeded even hawkish expectations. Trade policy remained a major market driver throughout the quarter, highlighted by a 90-day pause on reciprocal tariffs for negotiations, a 25% tariff on autos and parts, and a tit-for-tat escalation with China that peaked at 145% tariffs before a temporary détente. The U.S. struck an early trade deal with the U.K. which included some relief on auto tariffs and reduced trade barriers for American goods, while talks with other countries were ongoing. Some tariffs faced legal challenges, but the administration retained tools to reinstate them if needed.

The administration was also active in foreign policy. The U.S. reached a minerals deal with Ukraine in exchange for aid, though peace talks with Russia stalled. In the Middle East, tensions flared between Israel and Iran, which was capped off by U.S. military strikes on Iranian nuclear facilities. Fears that a broader conflict in the region would disrupt global energy markets proved short-lived after tensions quickly simmered.

On the economic front, sentiment surveys of consumers and businesses reflected considerable uncertainty amid the highest effective tariff rates since the Smoot-Hawley Tariff Act in 1930. However, the U.S. economy remained resilient: the unemployment rate was virtually unchanged and inflation softened. Real gross domestic product (GDP) growth dipped negative, driven primarily by wild swings in imports, but core measures of economic activity such as consumer spending and business investment remained on solid footing beneath the surface. The Atlanta Fed’s GDPNow model forecasted a Q2 rebound in economic growth.

Overseas, the Eurozone economy continued to benefit from easing inflation and looser fiscal policy. China’s ongoing economic recovery remained on uneven footing due to pressure from U.S. tariffs despite targeted stimulus efforts.

Navigating a Near-Term Growth Scare

The Federal Reserve kept rates unchanged in Q2, adopting a wait-and-see approach to whether tariffs posed a greater risk to inflation or growth. Its latest dot plot projected two potential rate cuts by year-end, though policymakers appeared split between those favoring cuts and those expecting to stay on hold. Market volatility briefly flared on concerns over Fed independence, especially as speculation grew around the administration’s pending nomination to replace Chair Powell.

Meanwhile, the House of Representatives passed its version of the “One Big Beautiful Bill Act” which raised the debt ceiling, extended expiring tax cuts, lifted the deduction cap for state and local taxes, and offset costs with cuts to Medicaid and clean energy. The Senate continued to draft its own version at quarter-end, with the projected debt ceiling X-date (i.e., when the government risks running out of cash) looming in late August.

Market Whiplash

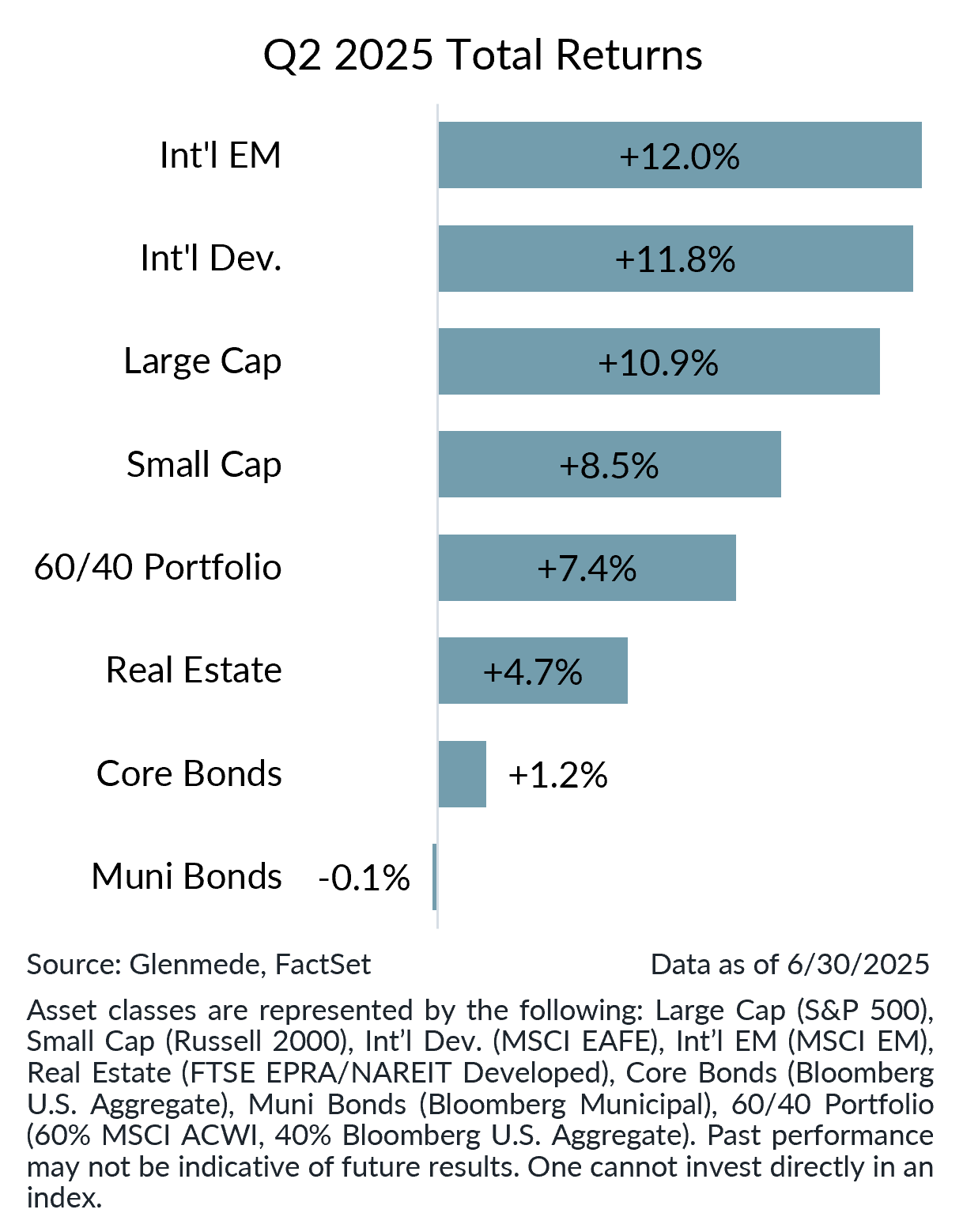

In the wake of the “Liberation Day” tariff announcement, the S&P 500 briefly flirted with a bear market, falling nearly 20% from its all-time high. Following one of the worst weeks for the index since 2020, the S&P 500 posted a ~10% single session gain and ultimately ended the quarter at a new all-time high, highlighting the opportunity costs for investors in wholesale portfolio de-risking efforts amid peak uncertainty and market fears. International equity markets continued to prove their place in diversified equity portfolios, with both international developed and emerging markets outperforming, assisted by the tailwind of a weaker U.S. dollar.

Fixed income markets were volatile in Q2. Long-term U.S. Treasury yields briefly rose on concerns about U.S. debt sustainability and deficit spending, culminating in a Moody’s downgrade of the U.S. sovereign credit rating. Municipal yields climbed on strong new issuance and fleeting doubts about the future of their tax-exempt status. High yield spreads widened in April on growth concerns but narrowed later in the quarter as economic sentiment improved.

Mid-Year Economic & Market Outlook

As the second half of 2025 begins, the economic outlook is highly sensitive to the path of government policy. Glenmede’s base case assumes modest progress on tariff negotiations; some duties may be reduced while others remain in place to support domestic manufacturing and strategic industries. This scenario may pose a -1.3% drag on real GDP over the next year, which is significant but unlikely to derail the ongoing U.S. expansion. Upside and downside cases remain plausible, depending on how far tariffs are rolled back through negotiations or legal challenges, or if they move forward largely as initially proposed.

However, trade policy is not operating in a vacuum. The reconciliation bill advancing through Congress could partially offset tariff headwinds in 2025, though much of its stimulus impact may not materialize until 2026. Monetary policy also hangs in the balance: if tariffs push inflation higher, the Fed may hold rates steady, but a few more quarters of benign inflation may give officials enough confidence to consider rate cuts beginning in late summer/early fall.

Investors should neither be lulled into complacency by the resilience of the ongoing economic expansion, nor should they be stunned into non-action by the variety of paths that the future may take. Market valuations have rebounded from their April lows but sit at more reasonable levels than at the start of the year. Yet beneath the surface, less growth-oriented domestic equities and smaller companies are available at more reasonable and even discount valuations. International equities, even after their outsized appreciation so far this year, also continue to offer compelling valuations.

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.