Gender Equity Investing in Active Management: A Broadening Approach

Summary

Gender equity investing seeks to invest for financial return while promoting gender diversity throughout the workplace. Though most public market strategies have remained focused on “women in leadership” metrics1 at the senior management and board of directors’ levels, the field of gender equity investing has expanded to encompass broader outcomes for employees, including resources, policies and programs that support gender diversity at all levels in the workplace.

The business case for gender equity

A growing body of research links women in leadership to strong corporate performance. Analysis shows that having diverse teams leads to value creation across several metrics, including long-term stock price performance with lower volatility. In 2021, board gender diversity was associated with a higher return on equity (ROE) for Russell 1000 companies; companies in the top quintile of female representation on boards exhibited a median ROE of 13.5% versus 12.5% for the lowest quintile.2 Specific to women in senior management, a study by Boston Consulting Group (BCG) found that operating margins of organizations with gender diverse management teams are 9% higher than those of organizations with below-average diversity.3 In Credit Suisse’s seminal gender diversity report scanning 3,000 companies across 56 countries, researchers found that companies with more women on management teams outperform their less equitable peers by over 4% per year.4

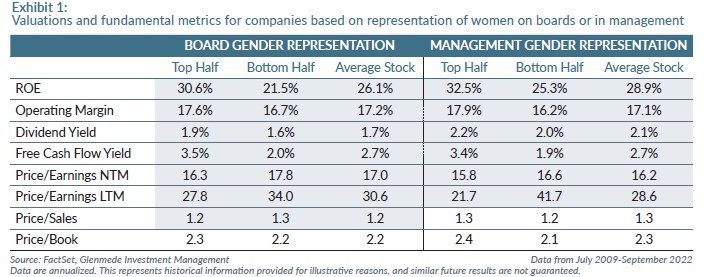

Glenmede Investment Management (GIM) has examined the relationship between gender representation and stock selection factors in the Russell 1000 Index by evaluating women on the boards and in management in two groups — companies with greater representation of women on boards or in management (top half) and companies with less representation (bottom half). Consistent with other findings, we note stronger average ROE and operating margins in the top half versus bottom half. Additionally, across several common valuation metrics (including dividend yield, free cash flow yield, price/earnings based on last 12 months and earnings estimates for next 12 months), we find stronger valuations for companies with greater gender balance (Exhibit 1). While price/book and price/sales do not show the same consistent relationship as other valuation factors, overall we believe the market overly discounts the value of companies with strong gender diversity. These results also complement the valuation discipline of Glenmede’s Quantitative equity strategies, including Glenmede Women in Leadership. (More information about the Glenmede Women in Leadership U.S. Equity strategy can be found here.)

What does empowering women at the top of the corporate ladder mean for women on the middle- and entry-level rungs? Initial studies indicate that increasing the number of women on boards may have a spillover effect by improving diversity throughout the company. For example, Credit Suisse found that companies with at least 5% women on boards have an average of 18% women in management.5 The proportion increases as the percentage of women on boards increases. Although this is not a causal relationship,6 this data suggests improving diversity on boards may lead to better gender balance in executive functions as well. Still, the fact that some women hold positions of power does not mean all levels of the company offer equitable compensation, healthcare benefits or treatment. This reinforces the importance of adopting a more robust approach to evaluating gender equity.7

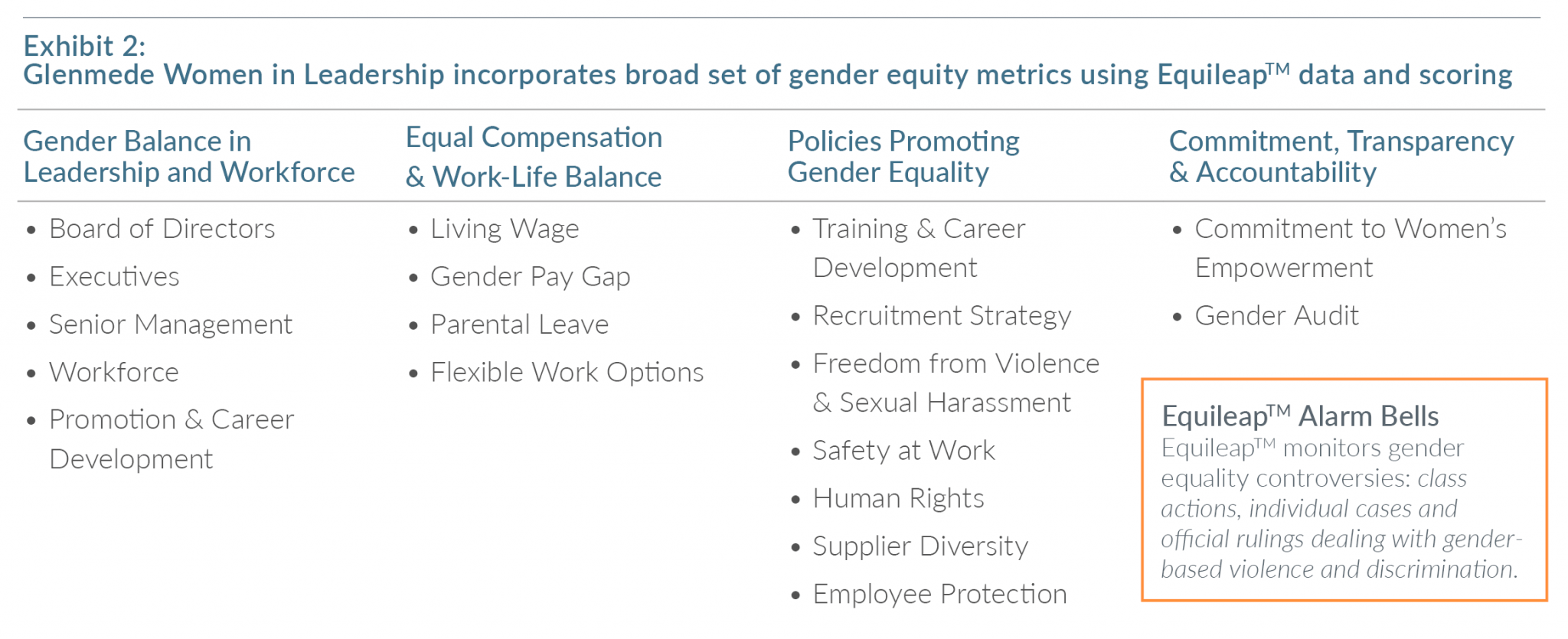

One way to tackle the incorporation of broader gender equity characteristics is by using Equileap’s Gender Equality Scorecard. Equileap’s data considers gender balance in leadership as well as characteristics such as pay equity, access to benefits, training and career development, antiharassment policies and diverse supply chains.8 Exhibit 2 shows the metrics incorporated into Equileap’s scoring system across four broad categories: Gender Balance in Leadership and Workforce, Equal Compensation & Work-Life Balance, Policies Promoting Gender Equity, and Commitment, Transparency & Accountability.

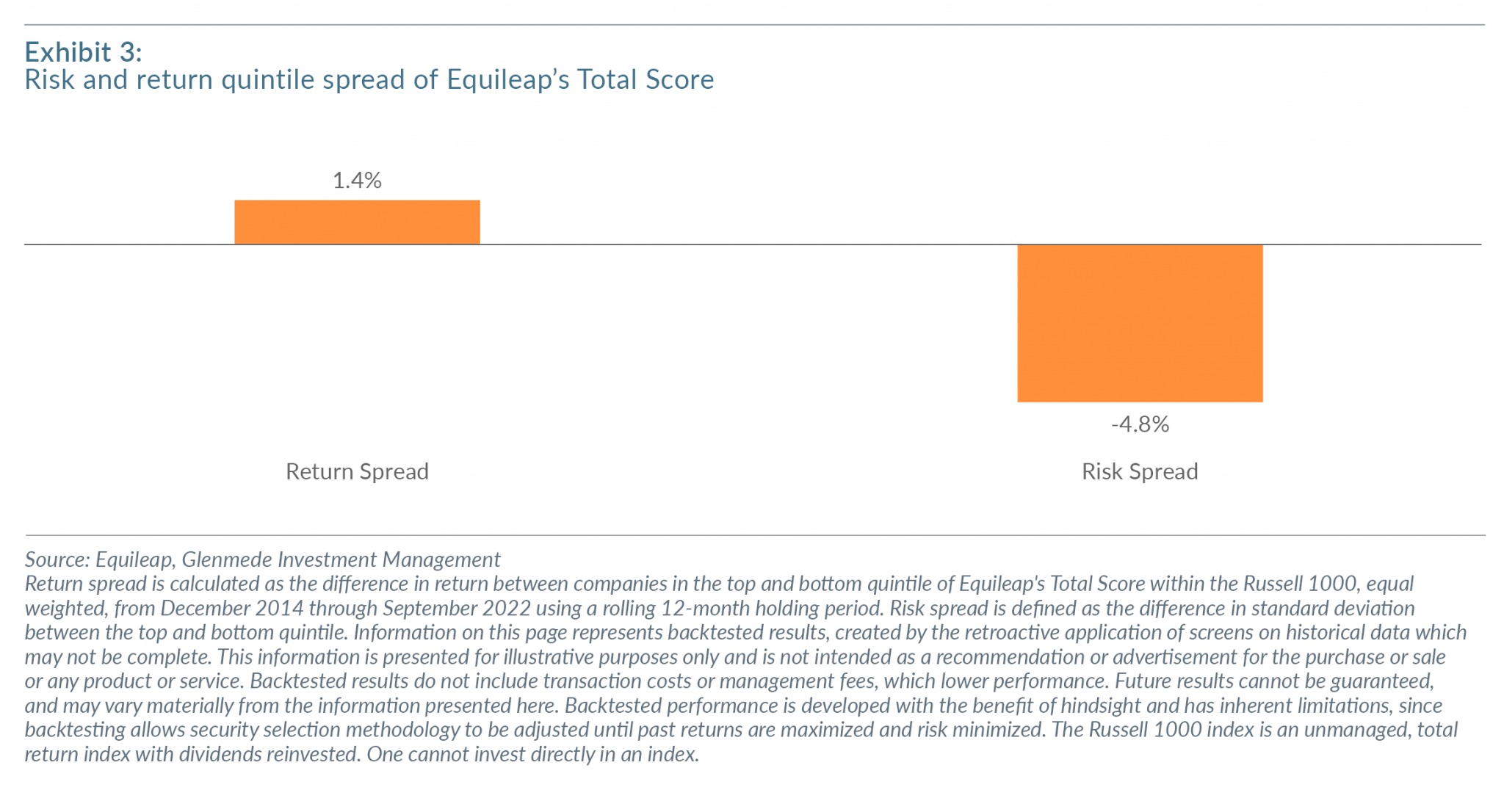

When evaluating Equileap data for companies in the Russell 1000 from December 2014 to September 2022, we found a potential relationship between broader gender equity factors and stock performance.9 Companies in the top quintile of Equileap’s Gender Equality Scorecard, or those demonstrating stronger gender equity as defined by Equileap, exhibit greater returns and lower risk than companies in the bottom quintile (Exhibit 3).

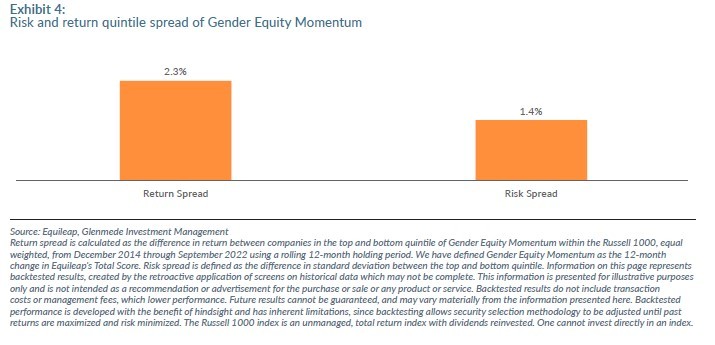

To highlight companies that have improved the most on Equileap’s criteria over prior periods and along similar lines to our previous research on ESG Momentum,10 we used the 12-month change in Equileap scores to create a Gender Equity Momentum factor — analogous to the industry standard Price Momentum factor. The top quintile of Gender Equity Momentum had stronger returns than the bottom quintile with a moderate, but not commensurate, increase in risk (Exhibit 4). This suggests a holistic approach to gender equity is warranted in portfolio construction.

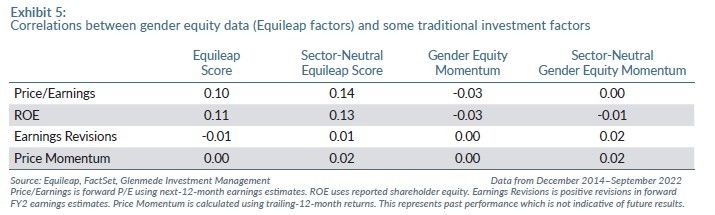

In addition, we found relatively low correlations between these gender-equity-focused factors and other common factors from our Russell 1000 stock selection factor library, demonstrating the potential diversification benefits of gender equity data when combined with valuation metrics, fundamental ratios, earnings revision signals and technical indicators. Exhibit 5 shows the average correlation between the Equileap Total Score and Gender Equity Momentum factors against price to earnings, ROE, earnings revisions and price momentum. We also show these correlation relationships on a sector-neutral basis, wherein we control for sector biases that may be present in a factor.

An evolving approach to gender equity investing

Since many of the datasets referenced above — especially Gender Equity Momentum — were not available to analyze at the inception of the Glenmede Women in Leadership strategy, GIM has refined its approach to gender equity investing over time. In 2015, there were few gender equity strategies available to address growing demand from retail investors, nonprofits and foundations. Internal analysis found that large cap companies with no women on their boards experienced higher risks and lower returns than their peers. Industry research at the time by Credit Suisse also found potential links between increased participation of women in senior management and stock performance.11

With these insights, GIM introduced the Glenmede Women in Leadership U.S. Equity strategy in December 2015, with an initial focus on investing in U.S. large cap companies meeting one of four criteria: chairwoman, a woman CEO, board composed of greater than 20% women or management composed of greater than 25% women. Companies that met these requirements were found to demonstrate lower risk and higher return than those which did not.12

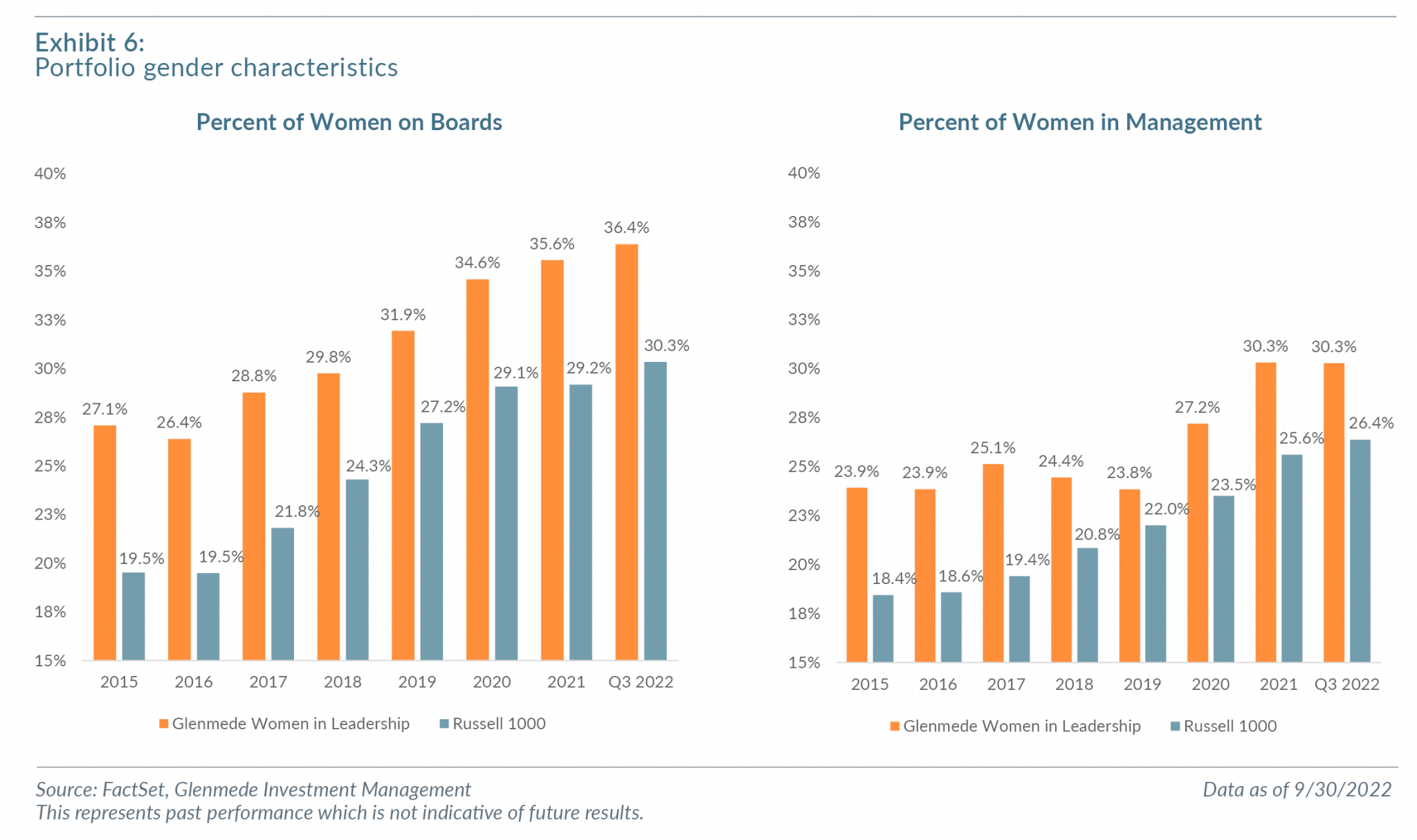

As the Women in Leadership characteristics of the average stock in the Russell 1000 have improved over time, we have increased the strategy’s minimum board and management representation criteria. At present, the strategy requires companies to have at least 33% women on boards or in senior management positions, representing the highest percentages at which, in our opinion, the strategy is still able to construct a well-diversified portfolio. GIM anticipates raising these requirements as the average company in the index improves. Exhibit 6 demonstrates how the gender characteristics of our portfolio have compared to the average stock in the Russell 1000 Index over time.

Research suggests that gender equity means bridging the historical gaps in gender equality by providing employees with policies such as maternal care, resources for management training and programs that foster a culture that supports women and can help position companies for long-term growth.13,14 This dynamic, in combination with research previously mentioned surrounding the financial materiality of diversity of gender in management positions, leads us to believe that companies with better gender equity policies may outperform their peers. For this reason, in January 2022 the Glenmede Women in Leadership strategy began incorporating Gender Equity Momentum to tilt toward companies with improvements in their gender equity characteristics.

A final area of focus is shareholder engagement. Gender equity investing strategies may offer a unique opportunity to include environmental, social and governance (ESG)-aligned proxy voting and shareholder resolution activity to help boost the investment theses. For example, our strategy routinely supports requests to release greater data around several issues important to gender equity and leadership, including:

- Gender and racial demographics

- Pay equity

- Anti-harassment safeguards

- Hiring, retention and promotion statistics to evaluate the efficacy of diversity, equity and inclusion programs and policies.

What’s next for gender equity investing

We continue to expect gender equity investing to evolve and investors to track three key issues:

-

-

- Sustained role of shareholder engagement. Support for board diversity proposals doubled from 2019 to 2021, paving the path for expanded requests.15 The 2022 proxy season continued to see resolutions requesting pay equity; hiring, retention and promotion rates; and board recruitment efforts to “deepen the bench” by increasing the percentage of women on boards. Shareholders are increasingly asking board representation to match the demographics, in terms of gender and race, of their underlying customers.16

-

2. Demand for greater data on gender and racial equity. Gender equity investors are increasingly seeking to incorporate data on gender and racial equity, conscious that gender equity is only one dimension of diversity. Resolutions are increasingly requesting pay equity disaggregated by gender and race and asking companies to go a layer deeper in assessing the effectiveness of their diversity, equity and inclusion programs and policies by participating in civil rights and racial equity audits.

3. Regulatory developments on human capital disclosure. Following the 2022 proxy season, we expect more granular data on hiring, retention and promotion of women and people of color to emerge, driven by investor interest as well as an anticipated Securities and Exchange Commission human capital disclosure proposal, asking for details on everything from company culture to offering a living wage to pay equity.17 Greater data on these points may inform investment analysis around a company’s ability to offer an inclusive environment, access to mentorship and pathway to promotion, supported by the idea that employee retention is linked to better financial performance.18,19

Conclusion

As we continue to evaluate the relationship between gender equity and shareholder equity in the context of portfolio construction, each potential development offers GIM new data and context to consider. We anticipate this more holistic approach to evaluating gender equity investing will become best practice moving forward.

As new information becomes available, GIM is committed to refining our investing approach, including our ESG product offerings in order to sharpen our focus on producing alpha.

1 Veris Wealth Partners. “Assets Grow to More than $3.4B.” March 4, 2020.

2 Shaheen Contractor and Christopher Cain. “Gender Valuation: Quality & Size See Correlations.” Bloomberg Intelligence, June 24, 2021.

3 Lorenzo, Rocio, Nicole Voigt, Miki Tsukaka and Katie Abouzahr. “How Diverse Leadership Teams Boost Innovation.” BCG, January 23, 2018.

4 Credit Suisse. Gender 3000 Report 2019 (p. 19).

5 Ibid.

6 Klein, Katherine. “Does Gender Diversity on Boards Really Boost Company Performance?” Knowledge @ Wharton, May 18, 2017.

7 “Four for Women: A Framework for Evaluating Companies’ Impact on the Women They Employ.” Wharton Social Impact Initiative. https://socialimpact. wharton.upenn.edu/research-reports/reports-2/four-for-women/.

8 “Equileap Gender Equality Scorecard.” Equileap. December 2020. www.equileap.com.

9 Equileap’s data is annual from 2014 to 2020 and quarterly thereafter. Our analysis is done on a rolling 12-month basis.

10 “Moving into the Mainstream: The Value of ESG Momentum.” https://www. glenmede.com/files/gim-esg-momentum-1q19.pdf.

11 The CS Gender 3000: Women in Senior Management (2015).

12 Enyart, Julia. “Gender Lens Investing in Public Markets: It’s More than Women at the Top.” Glenmede. https://www.glenmede.com/insights/gender-lens-investing-public-markets-more-than-women-at-top/.

13 “Charges Alleging Sex-Based Harassment, FY 2010-2021.” EEOC. https://www.eeoc.gov/statistics/charges-alleging-sex-based-harassment-charges-filed-eeoc-fy-2010-fy-2021.

14 “Equal Work, Unequal Pay: Risks of the Gender Wage Gap.” Risk Management, November 1, 2016.

15 “2021 Proxy Season Digest: Governance.” ISS. https://www.isscorporatesolutions.com/library/2021-proxy-season-digest-governance/.

16 Institutional Shareholder Services Inc. “2020 ISS Policy Survey Results” (p. 6). Sixty-one percent of investors believe that boards should aim to reflect the company’s customer base.

17 “New Human Capital Disclosure Requirements.” Harvard Law School Forum on Corporate Governance, February 2, 2021. https://corpgov.law.harvard.edu/2021/02/06/new-human-capital-disclosure-requirements/.

18 Abouzahr, Katie, Matt Krentz, Lauren Van Der Kolk and Nadija Yousif. “Measuring What Matters in Gender Diversity,” April 3, 2018. https://www.bcg.com/publications/2018/measuring-what-matters-gender-diversity.

19 “Diversity Wins: How Inclusion Matters.” McKinsey (May 2020). https://www.mckinsey.com/~/media/mckinsey/featured%20insights/diversity%20and%20inclusion/diversity%20wins%20how%20inclusion%20matters/diversity-wins-how-inclusion-matters-vf.pdf.

Any opinions, expectations or projections expressed herein are based on information available at the time of publication and may change thereafter, and actual future developments or outcomes (including performance) may differ materially from any opinions, expectations or projections expressed herein due to various risks and uncertainties. Information obtained from third parties, including any source identified herein, is assumed to be reliable, but accuracy cannot be assured. In particular, information obtained from third parties relating to “ESG” and other terms referenced in this article vary as each party may define these terms, and what types of companies or strategies are included within them, differently. Glenmede attempts to normalize these differences based on its own taxonomy, but those efforts are limited by the extent of information shared by each information provider. Definitional variation may therefore limit the applicability of the analysis herein. Any reference herein to any data provider or other third party should not be construed as a recommendation or endorsement of such third party or any products or services offered by such third party. Although Glenmede’s information providers, including without limitation, Equileap and its affiliates (the “ESG Parties”), obtain information from sources they consider reliable, none of the ESG Parties warrants or guarantees the originality, accuracy and/or completeness of any data herein. None of the ESG Parties makes any express or implied warranties of any kind, and the ESG Parties hereby expressly disclaim all warranties of merchantability and fitness for a particular purpose, with respect to any data herein. None of the ESG Parties shall have any liability for any errors or omissions in connection with any data herein. Further, without limiting any of the foregoing, in no event shall any of the ESG Parties have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

Equileap’s proprietary research methodology consists of a company-specific score-card, a framework that seeks to assess a company’s commitment to gender equal-ity and is inspired by the UN Women’s Empowerment Principles (the “Equileap Scorecard”).

The Equileap Scorecard was the result of extensive deliberation and engagement of an Expert Review Committee, which included practitioners and policy experts in the fields of women’s rights, academia, sustainable investment, and business. The result was the identification of 19 Criteria, divided into 4 Categories, which were considered critical in assessing company performance in gender equality:

A. Gender Balance in Leadership & Workforce – (5 criteria, 40% of the total score) In this category, Equileap measures female participation across all levels of the company. Equileap looks for balanced numbers of men and women at each level of the company (between 40-60% of each gender) and measure the progression of each gender to senior levels of the company.

B. Equal Compensation & Work-Life Balance – (4 criteria, 30% of the total score) In this category, Equileap measures company performance in regard to policies that enable work-life balance for both genders and ensure equal compensation. Companies are evaluated on a fair living wage policy, equal pay and the gender pay gap, provision of parental leave, and the availability of flexible work options.

C. Politics Promoting Gender Equality – (8 criteria, 20% of the total score)

In this category, Equileap evaluates companies in regard to eight policies that promote gender equality and make the workplace a safe place to work, where employees feel supported, irrespective of gender. Two key policies are antisexual harassment and supplier diversity policies. Under the first, Equileap looks for publicly available company policies that explicitly condemn sexual harassment and gender-based violence. Equileap evaluates a company’s commitment to diversity in the supply chain on whether it has a supplier diversity program that proactively procures from women-owned businesses.

D. Commitment, Transparency & Accountability – (2 criteria, 10% of the total score) In this category, Equileap evaluates a company’s formal commitment to gender equality. Equileap examines whether companies are a signatory to the United Nations WEPs and whether they have undertaken a gender audit carried out by an independent auditor. The Equileap research team conducts desk research using publicly available information provided by the companies themselves. Sources include: Corporate Sustainability Reports, Annual Reports, Filings, Company Websites, Integrated Reports, Sustainability Reports, Press Releases. One limitation is that the Equileap methodology skews toward companies that are more transparent and make their data publicly available. The Equileap Scorecard focuses on company policies and practices in the workplace. It does not account for practices in the communities in which companies operate or the gender composition of the customer base of the company. It assesses the reality of employees and parts of the supply chain, based on the information that the company discloses.

For more information about Equileap, visit their web page.