Market Updates

September 14, 2023

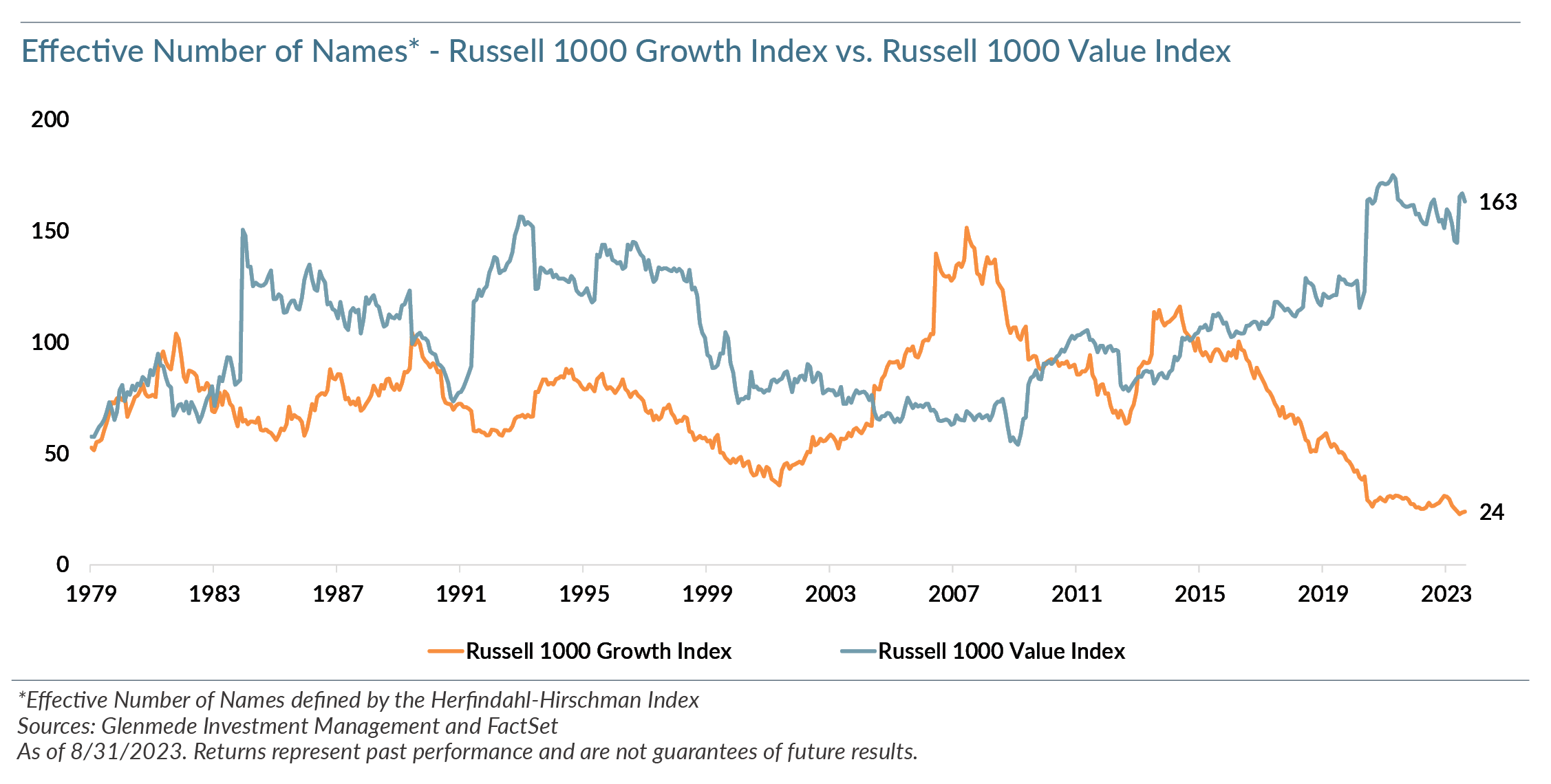

Market Snapshot: 445=24 When Indexing Does Not Diversify

- Currently, the Russell 1000 Growth and Value Indices have 445 and 845 constituents, respectively. However, according to the Herfindahl-Hirschman Index (HHI), a popular measure of market concentration, the Russell 1000 Growth Index has never been as concentrated, and the Russell 1000 Value Index has never been as diversified. The HHI is calculated by squaring the market share of each firm, and the “effective number of names” in an index is using the reciprocal of HHI. Based on these calculations, the Russell 1000 Growth Index has only 24 “effective” names, reaching an all-time low in June. Meanwhile, the Russell 1000 Value Index has 163 “effective” names, near an all-time high.

- The gap in relative concentration suggests the Russell 1000 Value Index is about 7 times more diversified than the Russell 1000 Growth Index. Before 2018, the ratio was never above 2.3. The current reading is a 4 standard deviation event dating back to 1979.

- We should also keep in mind that this measure is based on weights alone; the disparity between growth and value is even more stark when we consider that the largest growth names are all technology-oriented, and trade at roughly double the correlation of the average large cap stock. As an additional data point to the unusual weight of technology, according to Fama French data, the technology sector weight in recent years has been about 36%, which is larger than any other sector in the past 97 years (manufacturing would be next with a peak of 33.7% in 1956). We believe based on the “effective” names being at all-time lows and the sector concentration at all-time highs, it is becoming increasingly difficult to view the growth index as a diversified basket of stocks and would recommend active managers who can diversify away from these extreme levels of concentration.

Views expressed include opinions of the portfolio managers as of August 31, 2023, based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. Returns represent past performance and are not guarantees of future results. Actual performance in a given account may be lower or higher than what is set forth above. All investment has risk, including risk of loss. Designed for professional and adviser use.