Market Snapshot: Lottery Chances Versus Beating Magnificent Seven in 2023

Why do we continue to talk about the “Magnificent Seven” (Apple Inc., Microsoft Corporation, Alphabet Inc., Amazon.com, Inc., NVIDIA Corporation, Tesla, Inc. and Meta Platforms, Inc.)?

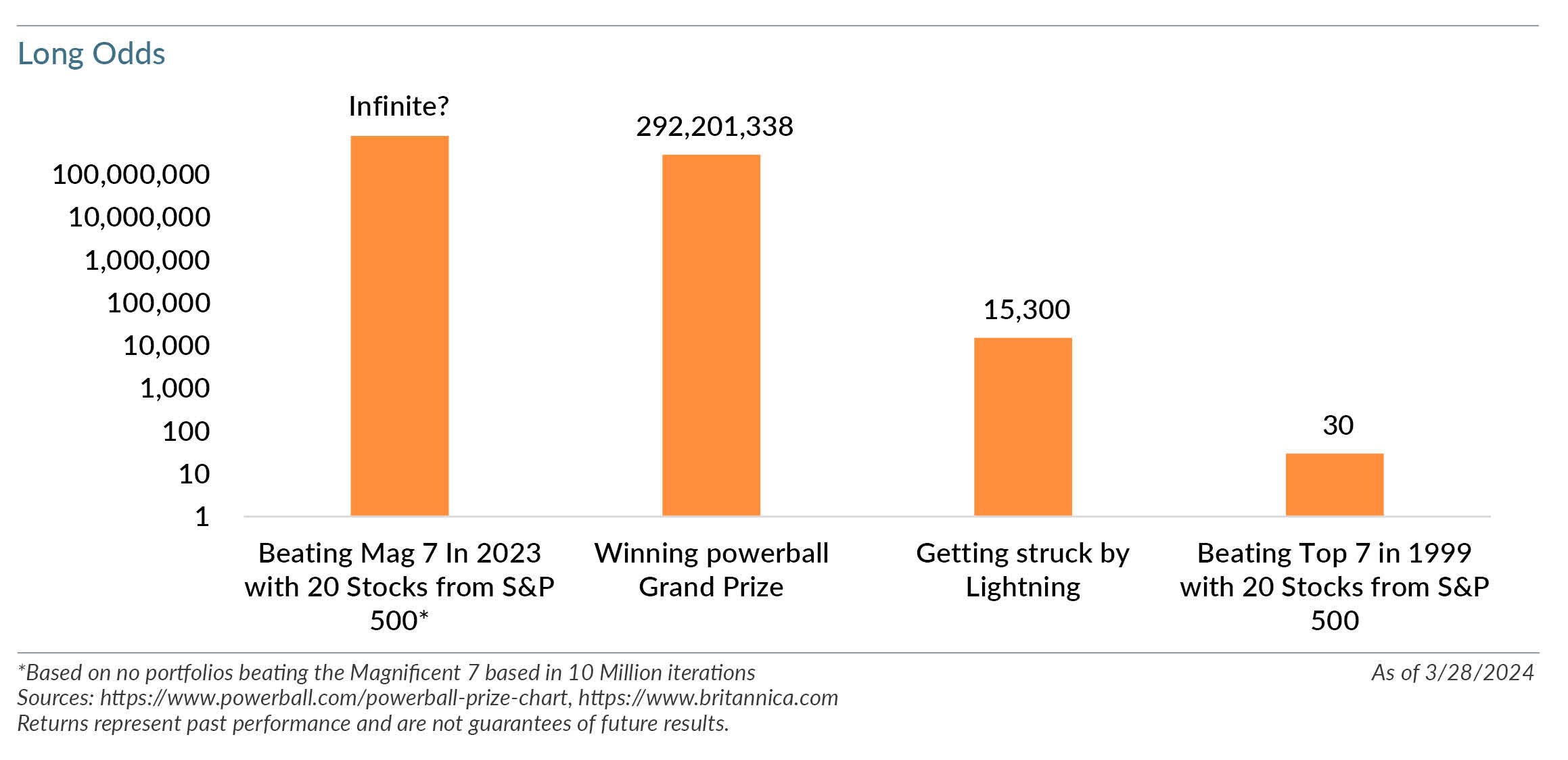

Because you may have had better luck winning the lottery than outperforming those seven stocks in 2023 with a reasonably concentrated portfolio of 20 other stocks.* Statistics show that the odds of outperforming the Magnificent Seven’s +86.8% return last year with any other portfolio of 20 stocks excluding those seven from the constituents of the S&P 500 index was almost impossible. Of the 10 million random iterations we ran of the 2.66×10^35 possible combinations (MATLAB simulations), we did not find any market cap or equal weighted portfolios with 20 stocks that would have outperformed the Magnificent Seven last year. Similarly, when using stocks from the Russell 1000 Growth index, none of the equal weighted and only 0.0066% of cap weighted 20 stock portfolios would have beaten the Magnificent Seven.

This current period of index concentration is often compared to the top-heavy market during the internet boom in 1999-2000. However, the “Dot-Com Bubble Seven” (Microsoft Corporation, Intel Corporation, IBM, Cisco Systems, Inc., Lucent Technologies, General Electric Company and Wal-Mart Stores) accounted for 21% of the weight in the Russell 1000 Growth index at the end of 1999 compared to over 47% of the index in the Magnificent Seven today (2/29/24). Unsurprisingly, there was a better chance to beat the seven largest names in 1999. Using the same methodology as above (10 million iterations of random 20-stock portfolios for the S&P 500 and Russell 1000 Growth Index constituents without the top seven names), only about 3.3% of the cap-weighted S&P 500 portfolios and 14.7% of Russell 1000 Growth portfolios would have outperformed the “Dot-Com Bubble Seven,” respectively.

We believe that market cap-based indices may offer a reasonable representation of the broader stock market performance over time, but their structure creates risk for investors because the companies with the highest weights have the highest market caps. To maintain those weights relative to an equal weighted index, those companies’ future earnings growth will need to exceed competitors or experience multiple expansion before the earnings are realized, both adding potential risks and volatility to the exposure. Additionally, these indices do not have guardrails to control individual stock or sector exposures. As of February 29, 2024, 29% of the S&P 500 weight was in those seven names and almost 30% of the index was in the information technology sector. This compares to weights almost half that at the start of 2017 (14.9% for the top seven stock weights and 13.7% weighting in information technology). Investors with large cap passive allocations would have benefitted from this historic runup in hindsight but are likely left with serious concentration risks today. We believe diversifying some of this exposure to actively managed large cap strategies that are well diversified with limits on individual stock exposures and reflect attractive characteristics, including valuations, fundamentals and technical, may reduce the historically notable concentration risk of passive indices while creating a more robust large cap allocation through a full market cycle.

*Published Powerball odds are 1 in 292.2 million. For reference, the odds of getting struck by lightning are roughly one in 15,300.

Views expressed include opinions of the portfolio managers as of February 29, 2024 based on the facts then available to them. All facts are gathered in good faith from public sources, but accuracy is not guaranteed. Nothing herein is intended as a recommendation of any security, sector or product. Returns represent past performance and are not guarantees of future results. Actual performance in a given account may be lower or higher than what is set forth above. All investment has risk, including risk of loss. Designed for professional and adviser use.