Market Snapshot: Escalating Conflict in the Middle East

The United States has joined the conflict in the Middle East, bombing three nuclear installations in Iran over the weekend. While forecasting the trajectory of geopolitical conflict is notoriously difficult, Iran’s response will be particularly telling in shaping the economic implications.

From a direct economic standpoint, the Middle East accounts for a relatively small share of global activity – roughly 5% of world GDP, trade and population. However, in an interconnected global economy, disruptions in the region can have far-reaching consequences. Second-order effects warrant close attention, particularly the potential impact on energy markets and the maritime chokepoints critical to their global distribution.

The Middle East is home to three of the world’s key shipping chokepoints: the Suez Canal, the Bab al-Mandab and the Strait of Hormuz. The latter has drawn particular focus given its proximity to Iran and the risk of closure amid an escalating conflict. Disruptions at any of these chokepoints could significantly impair global trade routes for energy and other goods moving between the major economies of Europe and Asia.

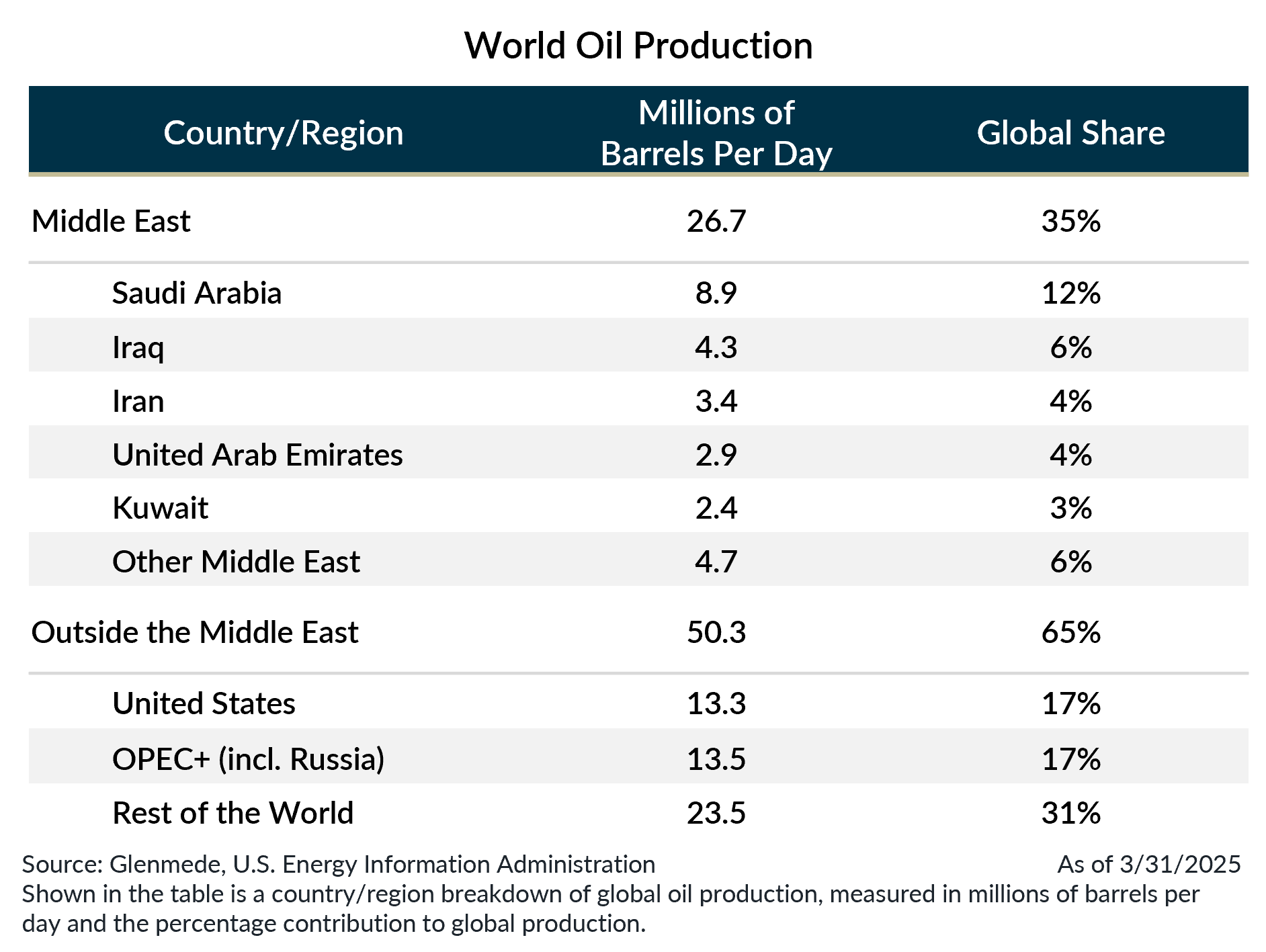

Oil and petroleum-related products are top exports for several Middle Eastern nations, with the region accounting for roughly a third of global crude oil production. Any material disruption to supply could reverse the decline in oil prices, which has been a key contributor to the year-to-date moderation in the Consumer Price Index.

Iran alone represents about 4% of global crude oil production, a figure that happens to roughly match OPEC’s current spare production capacity. In theory, this suggests that a disruption to Iranian output could be offset over the medium-term with limited market dislocation. However, that assumes the conflict remains geographically contained. Should tensions spill beyond Iran’s borders and impact other major oil-producing neighbors, the resulting supply shock would likely be far more difficult to manage. As such, the scope and duration of the conflict will be critical to monitor in the days and weeks ahead, particularly for their downstream impact on inflation.

Tariff-related price increases were already anticipated to begin reaching consumers over the summer. Now, with the added potential for elevated energy prices, concerns are mounting that inflationary pressures could become more pronounced and persistent than previously expected.

From a broader perspective, investors should be cautious about making material shifts in asset allocation based solely on geopolitical developments. History offers no shortage of events that appeared near-cataclysmic in the moment and triggered meaningful volatility. Yet, time and again, equity markets, especially those outside the immediate conflict zone, have demonstrated a remarkable ability to recover and resume their long-term growth trajectory. De-risking portfolios in environments where investors have limited predictive power can carry meaningful opportunity costs, especially if markets, as they often have historically, look through near-term risks.

Jason Pride, CFA

Chief of Investment Strategy & Research

Glenmede

Michael Reynolds, CFA

Vice President, Investment Strategy

Glenmede

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.