Market Snapshot: Expensive Gold—The Physical Bitcoin?

Gold has long maintained a distinctive role in diversified portfolios. Historically, it has functioned as a form of “insurance” by serving as a store of value, offering protection against geopolitical risk and at times acting as an effective inflation hedge. But as with any insurance policy, the price paid for protection matters.

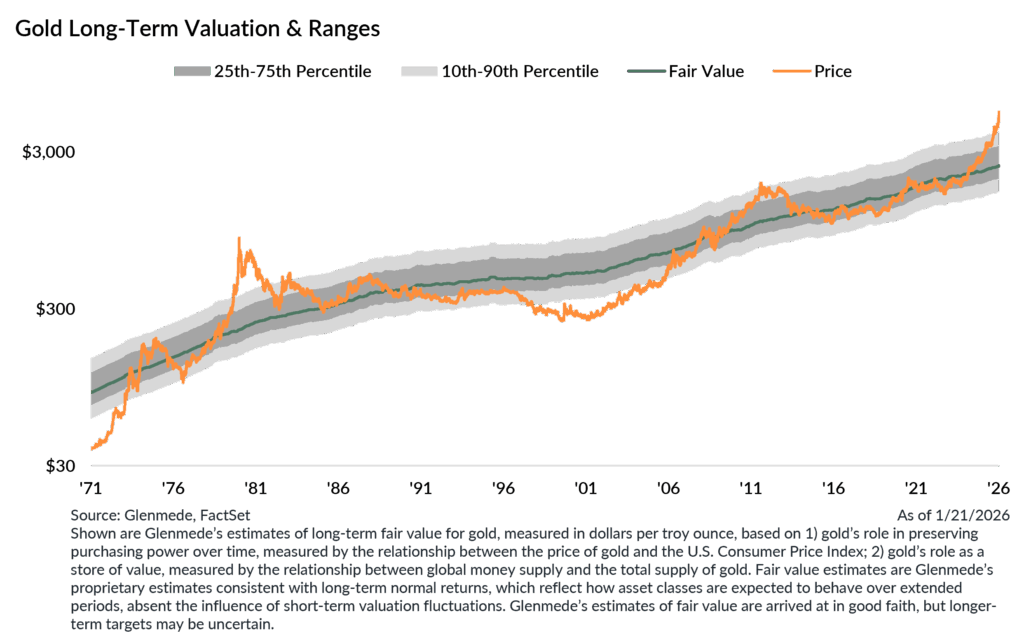

Based on Glenmede’s valuation framework, which evaluates gold relative to inflation-adjusted purchasing power and the global supply of currency, the metal currently sits at the 98th percentile of historical valuations. Few periods since the breakdown of Bretton Woods have seen gold trade at such a significant premium to its underlying fundamentals.

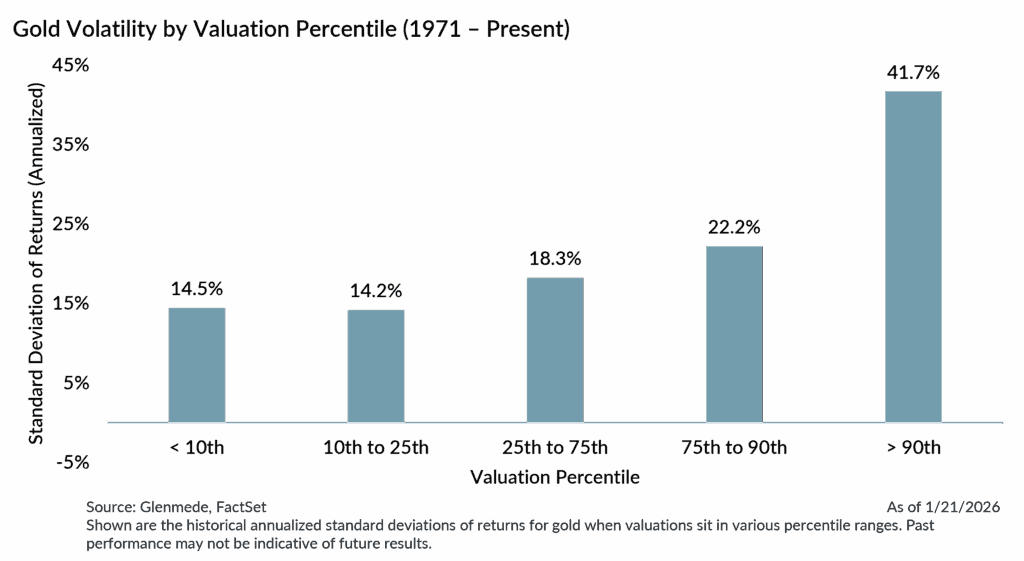

Elevated valuations alone do not necessarily guarantee poor forward returns, particularly in the short-run. However, history suggests they do alter the risk profile. As Benjamin Graham observed, “The intelligent investor realizes that stocks become more risky, not less, as their prices rise.” The same concept applies to the yellow metal. When gold has traded above the 90th percentile in this framework, the annualized standard deviation of returns has averaged roughly 42% compared with closer to 20% across all valuation regimes. Once gold becomes expensive, it tends to behave far less like a stable store of value and more like a high-volatility asset.

In fact, gold’s volatility profile in the highest valuation regime begins to resemble that of more speculative digital assets. While gold is often framed as the conservative alternative to bitcoin, periods of extreme overvaluation have historically pushed its behavior closer to that of riskier assets rather than safe havens.

Such elevated valuations may also have meaningful implications for prospective returns. Within Glenmede’s suite of capital market assumptions, gold is currently the only major asset class with a negative expected return for the next decade. At the same time, its projected volatility exceeds that of many growth-oriented assets, including equities. The combination of low expected returns and elevated volatility implies a particularly challenging risk-adjusted outlook relative to other asset classes.

In more typical valuation environments, gold can serve a constructive role in portfolios as a form of “insurance” against macro uncertainty. However, insurance tends to be most effective when the premium is reasonably priced. With valuations near historical extremes and volatility already elevated, the cost of that protection appears unusually high. Under such conditions, investors should exercise caution in chasing gold’s recent run of performance.

Jason Pride, CFA

Chief of Investment Strategy & Research, Glenmede

Michael Reynolds, CFA

Vice President, Investment Strategy, Glenmede

This material was produced by Glenmede Investment Management, LP or its affiliate The Glenmede Trust Company, N.A. (collectively, “Glenmede”) for informational purposes and is not intended as personalized investment advice to purchase, sell or hold any investment or pursue any particular strategy. Opinions and analysis expressed in this material are those of the author or investment team as of the date of preparation and may change without this document being updated. Views expressed do not necessarily reflect the opinions of all investment personnel at Glenmede and may not be reflected in all the strategies and products offered. Forecasts or estimates provided herein, including those related to market outlook are based on research including publicly available information, internally developed data and third-party sources believed to be reliable, but accuracy cannot be guaranteed. Future results may differ significantly depending on market, security specific, economic or political conditions. Charts and graphs provided herein are for illustrative purposes only. Past performance is no guarantee of future results. Indexes mentioned are unmanaged and do not include any expenses, fees or sales charges. It is not possible to invest directly in an index. Any index referred to herein is the intellectual property (including registered trademarks) of the applicable licensor. Any product based on an index is in no way sponsored, endorsed, sold or promoted by the applicable licensor and it shall not have any liability with respect thereto. Financial intermediaries are only permitted to distribute this material in accordance with applicable law and regulation. Such financial intermediaries are required to satisfy themselves that the information in this material is appropriate for any person to whom they provide it. Glenmede shall not be liable for the use or misuse of this material by any such financial intermediary.