Thought Leadership

Insights

September 19, 2023

Insights

September 19, 2023

GIM Small Cap Portfolio Manager Jordan Irving reexamines the Russell 2000 Index concentration of negative earners and the outsized influence that the lower quality nature of recent Initial Public Offerings has exerted.

Insights

September 14, 2023

Insights

September 14, 2023

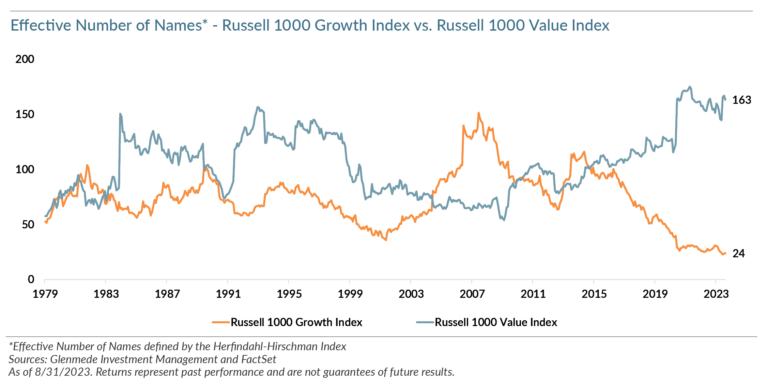

With the disparity of diversification between the Russell 1000 Growth and Value indices becoming more extreme, investors may want to seek active managers who can diversify away from these unprecedented levels of concentration. Learn more.

Insights

August 04, 2023

Insights

August 04, 2023

Historically, it was assumed that a higher cash reserve is a reflection of positive cash flows, indicates stability or at least a baseline level of liquidity, and that a higher proportion of CMV would indicate a discounted buying opportunity. However, research by the Quantitative Equity team at Glenmede Investment Management (GIM) has indicated that high proportions of cash or current assets to market value can actually be a proxy for higher volatility.

Insights

July 17, 2023

Insights

July 17, 2023

We are seeing unprecedented market concentration in broad-based indices.

Insights

May 03, 2023

Insights

May 03, 2023

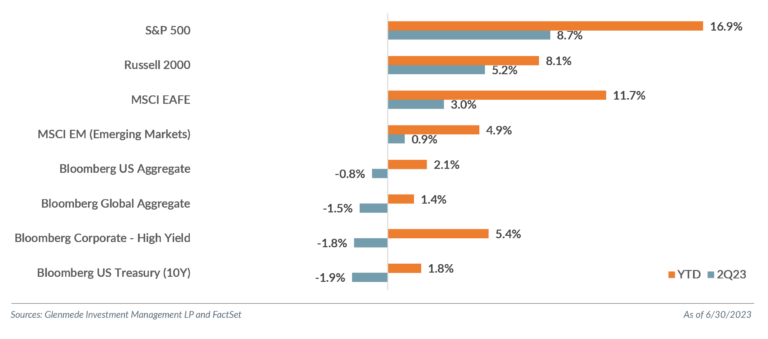

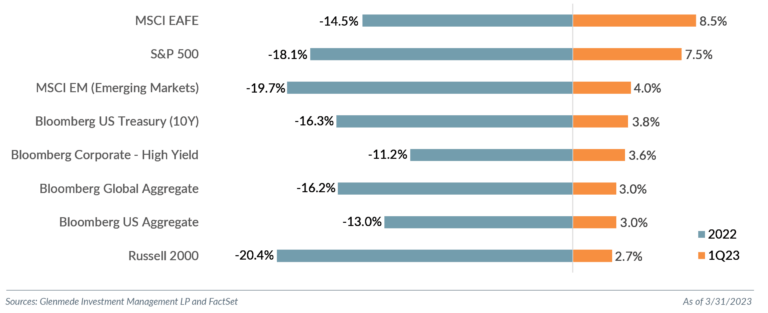

Equity markets rallied in Q1 2023, with much of what underperformed in 2022 reversing course to rebound sharply to start the year.

Insights

December 06, 2022

Insights

December 06, 2022

Our research suggests that it’s not just the presence of women in leadership positions, but broader gender equity characteristics that may contribute to stronger corporate performance.

Insights

February 28, 2022

Insights

February 28, 2022

We believe small cap stocks entered the correction phase of the negative earners’ outperformance in second-half 2021 and could continue to see relative weakness in these names throughout 2022.

Insights

February 23, 2022

Insights

February 23, 2022

We look at the current valuation of small caps and consider the potential behavioral implications that typically emerge during investment regime changes.

Insights

November 16, 2020

Insights

November 16, 2020

The rapid equity market rebound following the historic drawdown in March 2020 has been anything but expected. Investors have continued to support mega-cap growth

stocks which appear to be significantly overvalued by a number of different measures. With multiple indicators signaling significant risk based on historical trends, investors would be prudent to prepare for a market correction and shift to a more valuation-based assessment of the currently in-favor growth stocks.

Insights

October 31, 2020

Insights

October 31, 2020

Historical evidence suggests that periods of outperformance by negative earning stocks is not a new phenomenon. This outperformance has tended to be cyclical, not persistent, and concentrated around speculative environments.