Quantitative Large Cap Growth Equity

A Strong Track Record

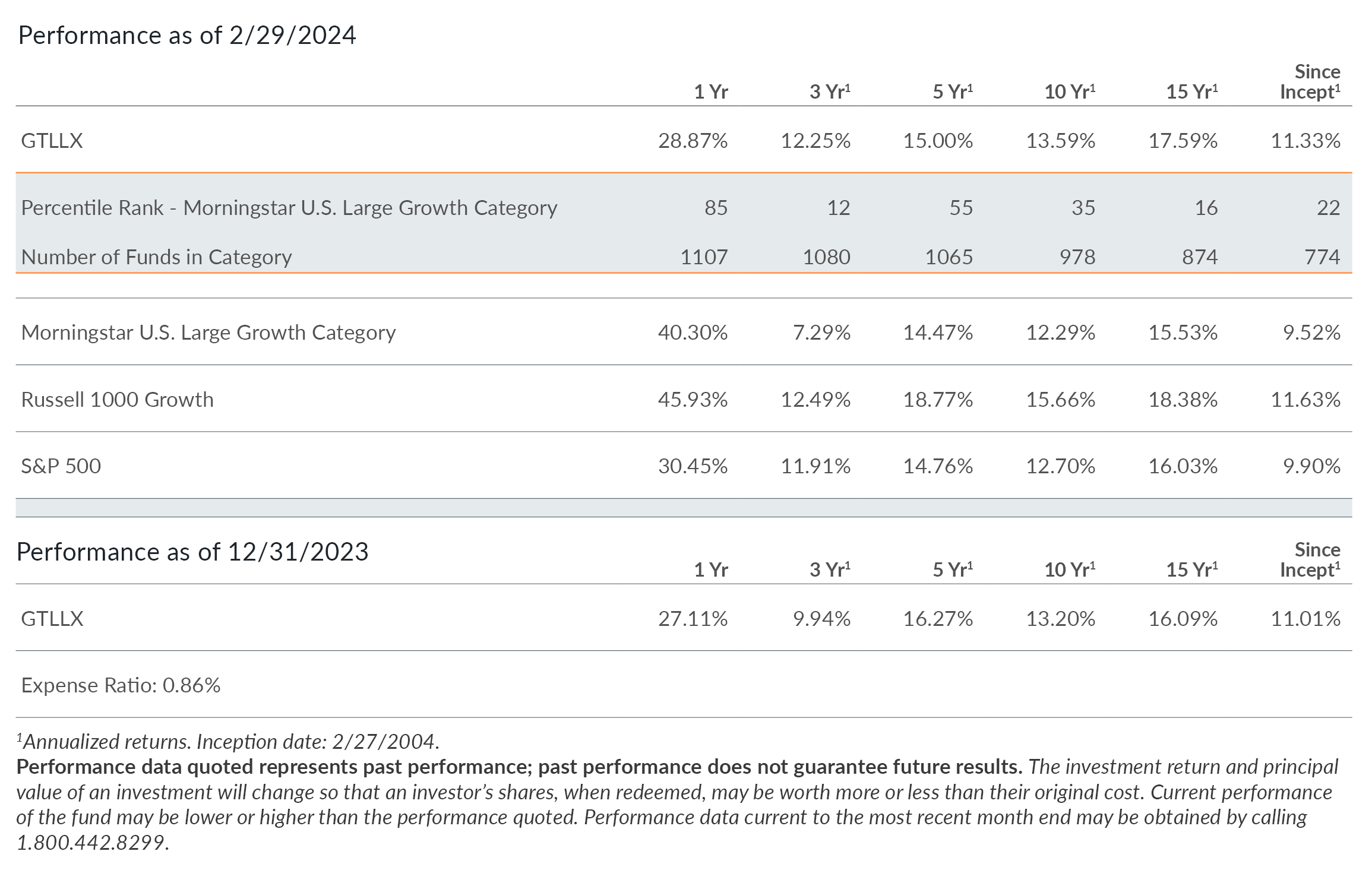

Glenmede Investment Management, LP is pleased to announce that the Glenmede Quantitative U.S. Large Cap Growth Equity Portfolio (GTLLX), launched on February 27, 2004, is now celebrating two decades of consistent performance, having survived where less than 1/3 of the competitors from 2004 still exist in the Morningstar US Fund Large Growth category, and ranking in the top quarter since inception based on total returns.

Over time, GTLLX has outperformed the average large cap growth fund and delivered consistent value since inception. For periods ending February 29, 2024, the fund performance ranked in the top 35% of the large cap growth funds (with 20-year records in the Morningstar US Fund Large Growth category) for 3, 10, 15 and 20 years, respectively.

Although, the last 10 years has been challenging for many active equity managers with the performance of major equity benchmarks dominated by a few large technology related stocks, the Glenmede Quantitative US Large Cap Growth Equity strategy has succeeded while using a multi-factor approach favoring stocks with more attractive valuations, high cash flows, stronger fundamentals, positive earnings/revenue estimate trends and favorable technicals, while seeking to limit downside risks by avoiding stocks with negative earnings surprise signals and controlling individual stock weightings. As a result, the portfolio has consistently reflected lower valuations and average market capitalizations versus the index.

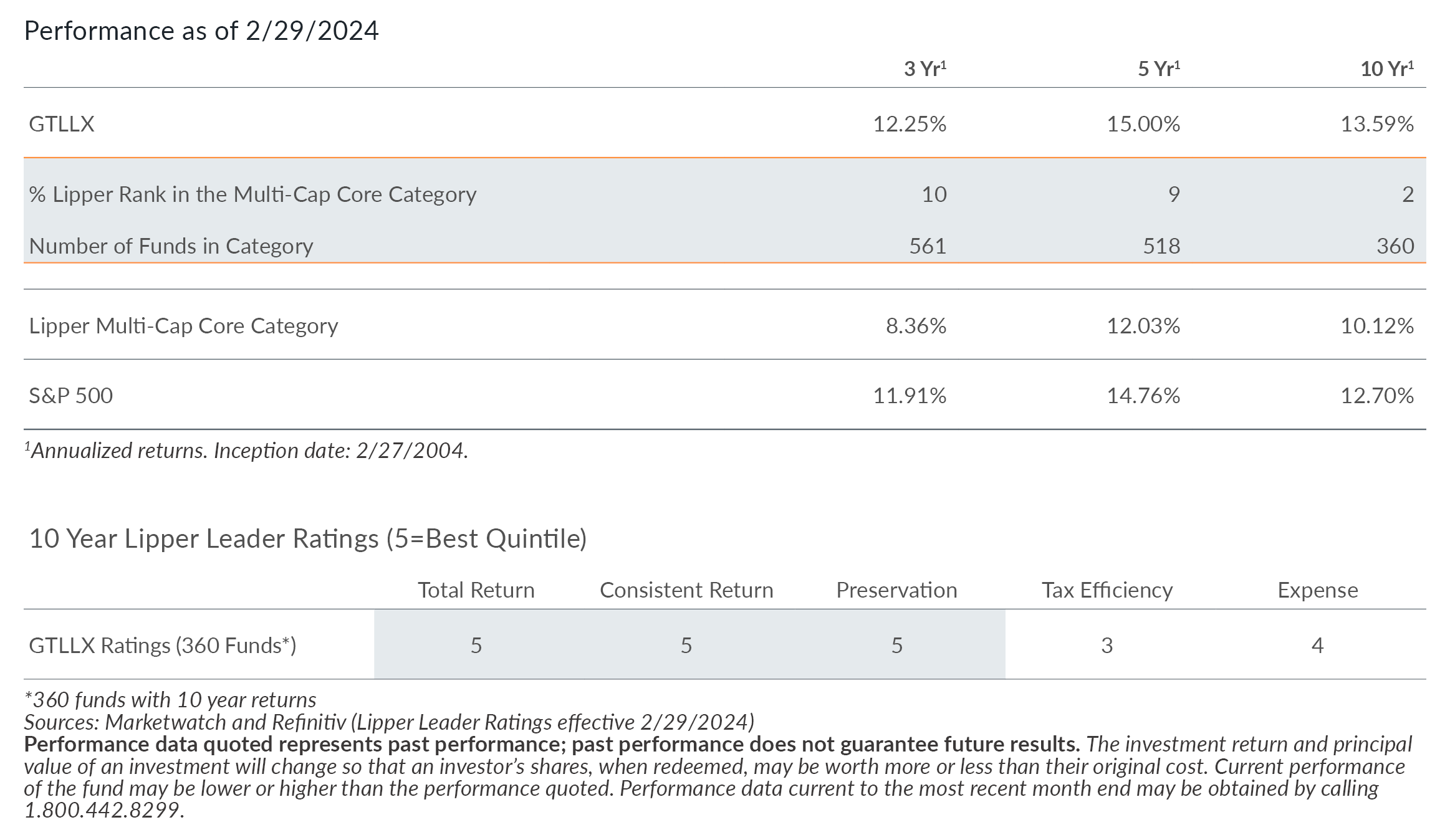

For the last 10 years, in comparison to equity funds with similar styles based on Lipper characteristics (valuation and market capitalization), GTLLX is ranked in the 2nd percentile for total return. The fund has ranked as a Lipper Leader (top quintile) for total return, consistent return and preservation, respectively. The Fund has received three Lipper Awards for top fund in its category and was recognized with the Lipper Award for Excellence in Fund Management. The award recognizes outstanding asset managers who have delivered consistently strong risk-adjusted returns to their investors and, in the opinion of Lipper’s research analysts, represent the best of the funds industry.

Lipper Award for Excellence in Fund Management

For the past 20 years, through collaborative teams and a commitment to a consistent decision-making process, our strategy has provided long-term value for our clients.

Glenmede Investment Management

Glenmede Investment Management (“GIM”) is an independently owned boutique asset management company offering actively managed equity, fixed income, derivative, and environmental, social and governance (“ESG”) strategies. We serve a global client base of institutions, consultants and advisors. Through experienced, collaborative teams and the implementation of a comprehensive investment approach, we seek to provide long-term value that addresses various investment objectives for our investors.

The fund’s investment objectives, risks, charges and expenses must be considered carefully before investing. The Glenmede Funds’ prospectus contains this and other important information about the investment company, and it may be obtained by calling 1.800.442.8299, or visiting www.glenmedeim.com. Please read the prospectus carefully before you invest or send money. Mutual fund investing involves risks; principal loss is possible. The Fund may invest in foreign securities which involve greater volatility and political, economic and currency risks and differences in accounting methods. The Fund may invest in IPOs and the market value of IPO shares could fluctuate considerably due to factors such as the absence of a prior public market, unseasoned trading, the small number of shares available for trading, and limited information about the issuer. Diversification does not assure profit, nor does it protect against loss in a declining market. All returns are calculated in U.S. dollars. Total returns comprise price appreciation/depreciation and income as a percentage of the original investment.

Percentile rank is a standardized way of ranking items within a peer group, in this case, funds with the same Morningstar category. The observation with the largest numerical value is ranked one; the observation with the smallest numerical value is ranked 100. The remaining observations are placed equal distance from one another on the rating scale. Note that lower percentile ranks are generally more favorable for returns (high returns), while higher percentile ranks are generally more favorable for risk measures (low risk).

Large-growth portfolios invest in big U.S. companies that are projected to grow faster than other large-cap stocks. Stocks in the top 70% of the capitalization of the U.S. equity market are defined as large-cap. Growth is defined based on fast growth (high growth rates for earnings, sales, book value, and cash flow) and high valuations (high price ratios and low dividend yields). Most of these portfolios focus on companies in rapidly expanding industries.

© 2024 Morningstar, Inc. All Rights Reserved. The information contained herein (1) is proprietary to Morningstar (2) may not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any sue of this information.

As of February 29, 2024, only 148 of the 458 (<33%) different funds in the Morningstar large growth category in 2004 remained in the category. GTLLX is ranked in the top 25 of survivors with an annualized return of 11.34%, outperforming the median fund (annualized return of +10.18%) by about +1.16%. Performance data quoted represents past performance; past performance does not guarantee future results.

The Russell 1000 Growth and S&P 500 Indexes are unmanaged, market value weighted indexes, which measure performance of the largest companies in the market. Returns include the reinvestment of dividends and other income. One cannot invest directly in an index.

A Lipper Fund Award is awarded to one fund in each Lipper classification for achieving the strongest trend of consistent risk-adjusted performance against its classification peers over a three, five or ten-year period. A Lipper Award for Excellence in Fund Management is awarded to candidates evaluated on criteria comprising total returns, risk-adjusted returns, expenses and tenure.

Although Lipper makes reasonable efforts to ensure the accuracy and reliability of the data contained herein, the accuracy is not guaranteed by Lipper. Users acknowledge that they have not relied upon any warranty, condition, guarantee, or representation made by Lipper. Any use of the data for analyzing, managing, or trading financial instruments is at the user’s own risk. This is not an offer to buy or sell securities. Lipper Analytical Services, Inc. is an independent mutual fund research and rating service.

The Lipper Leader Rating System is a toolkit that helps guide investors and their advisors in selecting funds that suit individual investment styles and goals. The Lipper Leader Rating System uses investor centered criteria to deliver a simple, clear description of a fund’s success in meeting certain goals, such as preserving capital or building wealth through consistent, strong returns. The strength of Lipper Ratings are their use in conjunction with one another. They can be used together to identify funds that meet the particular characteristics of the investor.

The Lipper Ratings are derived from highly sophisticated formulas that analyze funds against clearly defined criteria. Funds are compared to similar funds, and only those that truly stand out are awarded Lipper Leader status. Each fund is ranked against its peers based on the metric used (such as Total Return or Expense), and the highest 20% of funds in each peer group are named Lipper Leaders, the next 20% receive a rating of 4, the middle 20% are rated 3, the next 20% are rated 2, and the lowest 20% are rated 1. While Lipper Leader Ratings are not predictive of future performance, they do provide context and perspective for making knowledgeable fund investment decisions.

The ratings are subject to change every month and are calculated for the following periods: three-year, five-year, ten-year, and overall. The overall calculation is based on an equal-weighted average of percentile ranks for each measure over three-, five-, and ten-year periods (if applicable).

Lipper Ratings for Total Return reflect funds’ historical total return performance relative to peers. A Lipper Leader for Total Return may be the best fit for investors who want the best return, without looking at risk. This measure alone may not be suitable for investors who want to avoid downside risk. For more risk averse investors, Total Return ratings can be combined with Preservation and/or Consistent Return ratings to make a risk-return trade-off decision.

Lipper Ratings for Consistent Return reflect funds’ historical risk-adjusted returns, adjusted for volatility, relative to peers. A Lipper Leader for Consistent Return may be the best fit for investors who value a fund’s year-to-year consistency relative to other funds in a particular peer group. Investors are cautioned that some peer groups are inherently more volatile than others, and even a Lipper Leader for Consistent Return in a volatile group may not be well-suited to shorter-term goals or less risk-tolerant investors.

Lipper Ratings for Preservation reflect funds’ historical loss avoidance relative to other funds within the same asset class. Investors are cautioned that equity funds have historically been more volatile than mixed equity or fixed income funds and that even a Lipper Leader for Preservation in a more volatile asset class may not be well-suited to shorter-term goals or less risk-tolerant investors.

Lipper Ratings for Tax Efficiency reflect funds’ historical success in postponing taxable distributions relative to peers. A Lipper Leader for Tax Efficiency may be the best fit for tax-conscious investors who hold investments that are not in a defined benefit or retirement plan account.

Lipper Ratings for Expense reflect funds’ expense minimization relative to peers with similar load structures. A Lipper Leader for Expense may be the best f it for investors who want to minimize their total cost and can be used in conjunction with Total Return or Consistent Return ratings to identify funds with above average performance and lower-than-average cost.

The Fund is distributed by Quasar Distributors, LLC.