Thought Leadership

Insights

March 13, 2024

Insights

March 13, 2024

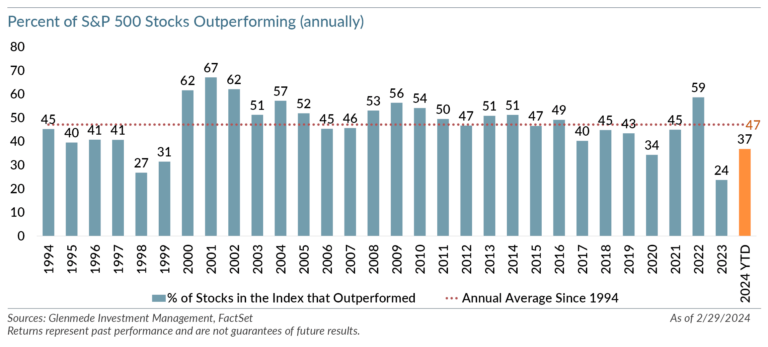

As of the first two months of 2024, market participation of the S&P 500 constituents has increased from last year’s 30-year lows. As shown in the chart, …

Insights

March 05, 2024

Insights

March 05, 2024

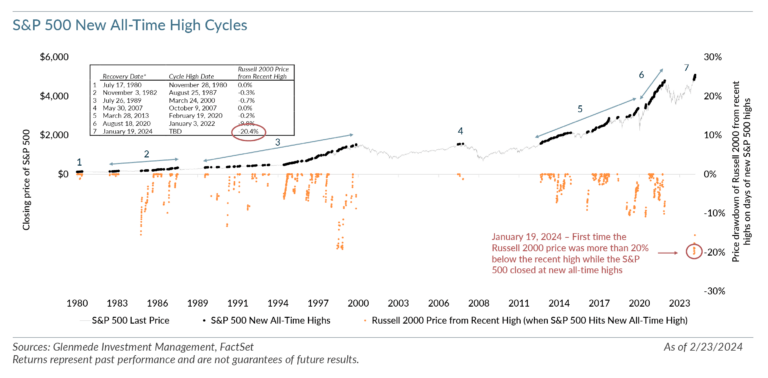

The S&P 500 began a new all-time high price cycle¹ on January 19, 2024, and as of February 23 had posted 13 new all-time highs during 25 …

News

February 27, 2024

News

February 27, 2024

Glenmede Investment Management Appoints Scott J. Kearney as Director of Global Distribution Philadelphia, PA — February 27, 2024 — Glenmede Investment Management (GIM), an independently owned boutique …

Insights

February 08, 2024

Insights

February 08, 2024

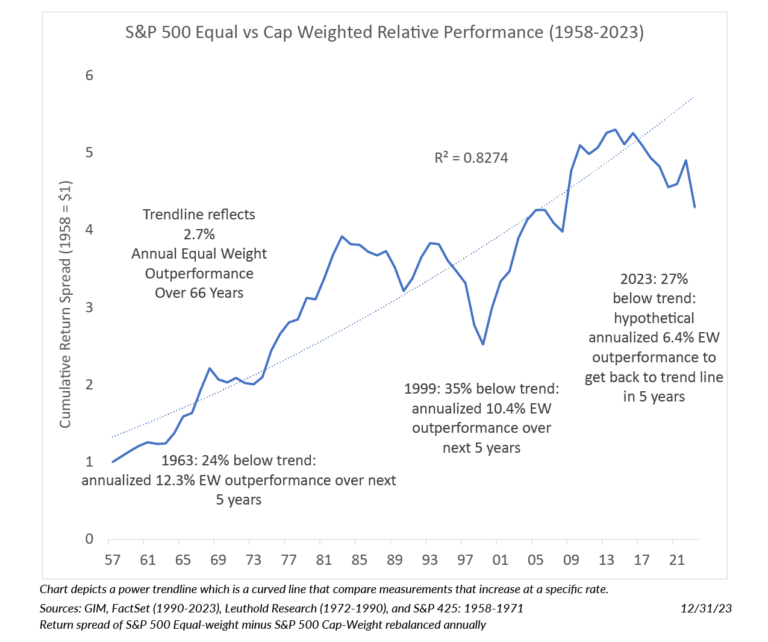

We have repeatedly discussed the increase in market concentration¹ for U.S. large cap stocks and the potential concentration risk for investors in large cap passive strategies. The …

Insights

January 23, 2024

Insights

January 23, 2024

We are seeing unprecedented market concentration in broad-based indices.

Insights

January 03, 2024

Insights

January 03, 2024

Beyond the Surface: Peripheral Impacts of a Higher Cost of Capital on Small Cap Markets In our October 2020 paper “Why Profitability Matters: Positive Versus Negative Earnings,” …

Insights

November 07, 2023

Insights

November 07, 2023

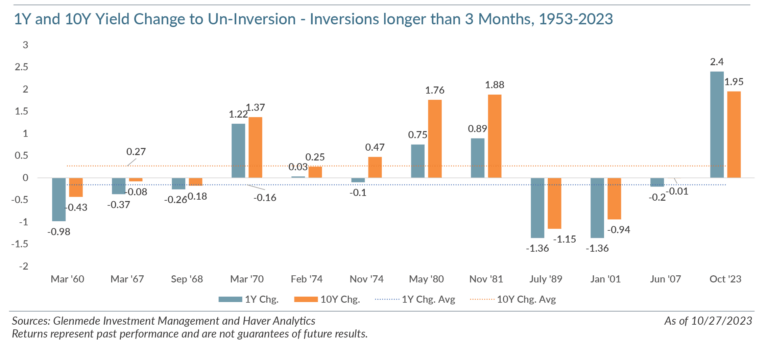

Instead of debating the likelihood of a recession, we compare the behavior of the yield curve during the “un-inversion.”

Insights

October 19, 2023

Insights

October 19, 2023

We are seeing unprecedented market concentration in broad-based indices.

Insights

October 04, 2023

Insights

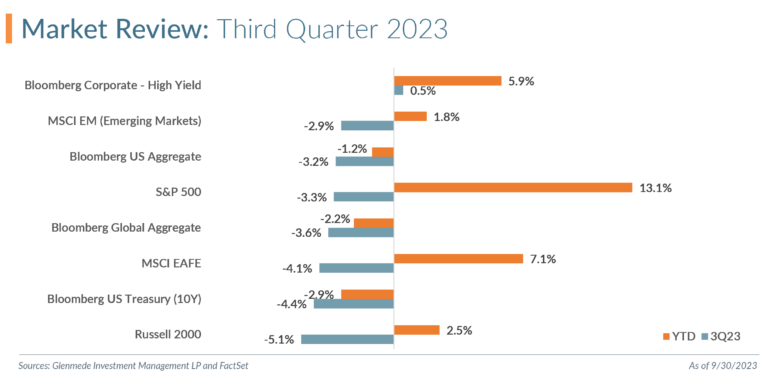

October 04, 2023

Market cap-weighted index funds reflect several risks to the investor. An experienced active manager can effectively reduce some of these risks with quantitative tools, a valuation discipline, fundamental research, and portfolio optimization techniques.

Insights

September 28, 2023

Insights

September 28, 2023

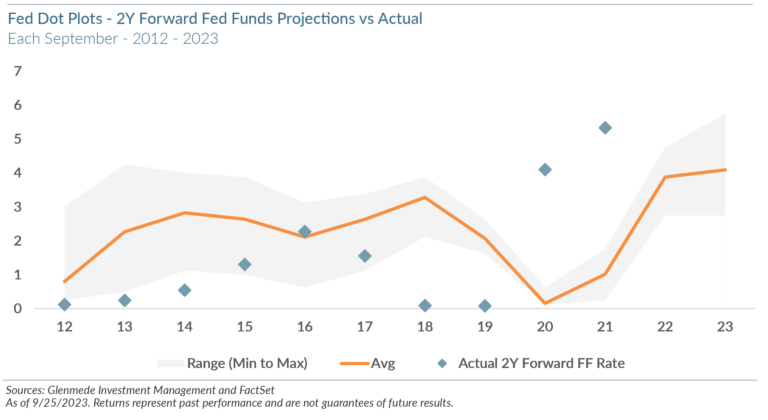

What’s Wrong With This Picture? The Fed’s dot plot is again causing a stir as investors try to glean wisdom about the long-term trajectory of interest rates. …